Do Credit Cards Have Routing Numbers?

5 Min Read | Published: April 16, 2024

This article contains general information and is not intended to provide information that is specific to American Express products and services. Similar products and services offered by different companies will have different features and you should always read about product details before acquiring any financial product.

Credit cards don’t use routing numbers like checking and savings accounts do. Instead, credit card transactions use credit card numbers.

At-A-Glance

- A routing number is a nine-digit identifier for a bank or financial institution.

- Credit cards do not have routing numbers. Checking and savings accounts do.

- Card numbers, expiration dates, and Card Verification Value (CVV) codes are identifiers for credit cards.

You might be wondering if your credit card has a routing number. The short answer is no, it doesn’t.

Credit cards have an account number that’s displayed on the card, an expiration date, and a Card Verification Value (CVV) code. Debit cards, on the other hand, are attached to a bank account, which does have a routing number. In this article, we’ll explain what a routing number is, why it’s used, and where you can find it.

What Is a Routing Number?

A routing number is a nine-digit unique identifier used by banks and other financial institutions in the United States. It ensures that fund transfers between financial institutions are routed correctly. They are not used outside of the United States. For international money transfers, international bank account numbers (IBANs) or Society for Worldwide Interbank Financial Telecommunication (SWIFT) codes may be used.1

The system was invented in 1910 by the American Bankers Association (ABA) to help make it easier to process paper checks between banks.2 Initially, it was a system to help the ABA process checks, which is why the identifiers are also called ABA routing numbers or ABA numbers. These monikers all refer to the same nine-digit code.

Banks are given routing numbers based on the states in which they operate. So banks in different states will have different routing numbers.

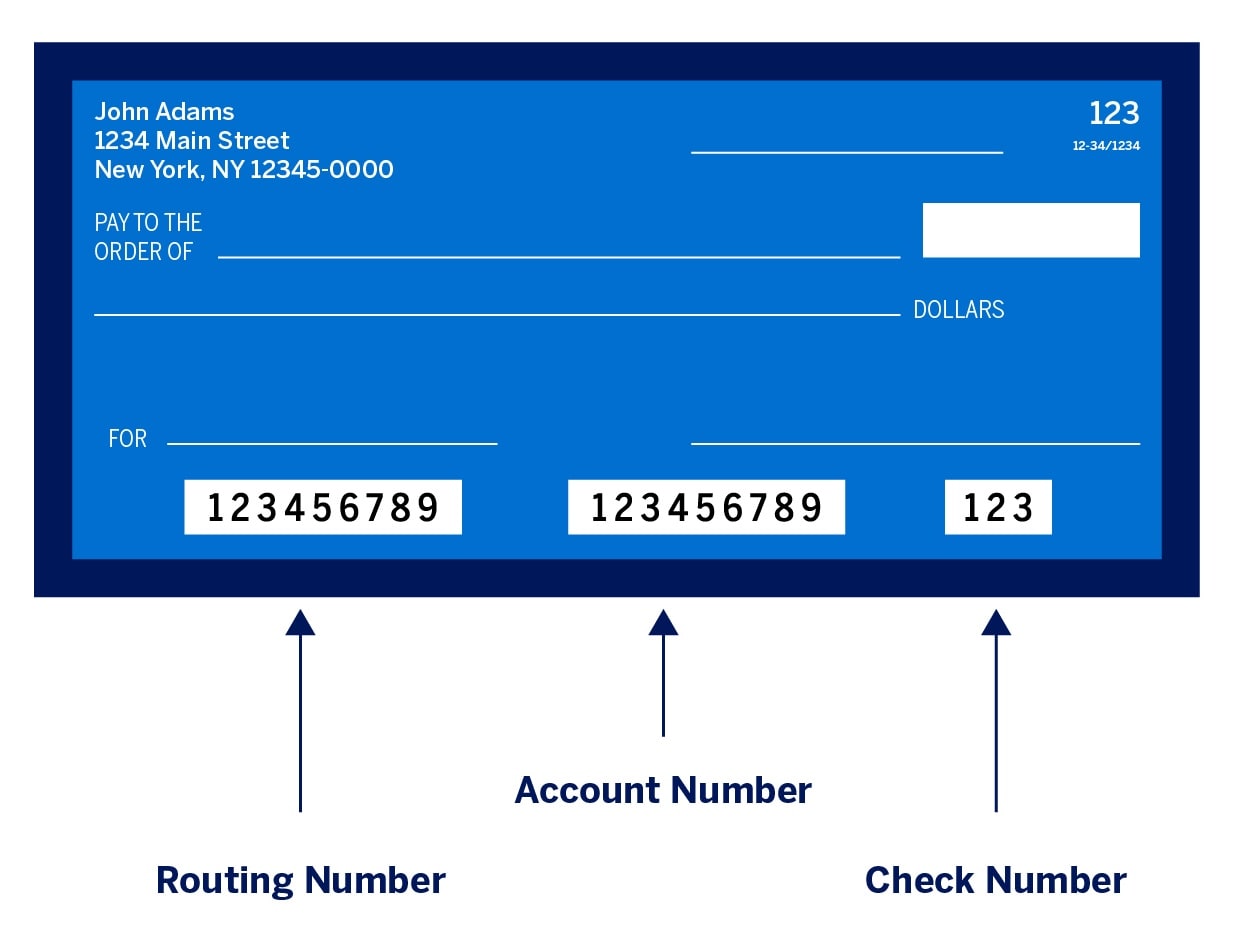

If you have a checking account, your bank’s routing number is displayed in the bottom left-hand corner of your checks. The numbers following that nine-digit identifier are your account number. The combination of those two elements accurately identifies the financial institution and the individual account that is either sending or receiving money.

Why Don’t Credit Cards Use Routing Numbers?

A routing number identifies a specific financial institution. It’s an essential identifier when transferring money from one bank account to another. That’s not what happens when you use your credit card. With a credit card transaction, you’re borrowing funds against your credit limit, and this transaction will be processed differently. The credit card number helps to track your transactions and ensure they end up on your monthly bill and helps the card processors identify the financial institution that will settle the payment.

Credit Card Identification

Credit cards don’t have routing numbers. The unique identifier for a credit card is a number that’s typically fifteen to twenty-one digits long displayed on the front or back of the card. The first number in the sequence identifies the credit card provider. For instance, American Express credit card numbers (CCN) are fifteen digits starting with a 34 or 37.

Another identifier on your credit card is the expiration date. Most merchants will ask for this when you make a purchase over the phone and check it when you buy something in person. An expired credit card will typically register as “invalid” if you try to swipe it or make an online purchase with it. Your credit card provider should notify you when your card is set to expire.

The third identifier on a credit card is the card verification value (CVV) code. On most cards, it’s a three-digit security code printed on the back of the card. American Express uses a four-digit code printed on the front of the card. This feature, combined with chip technology used to encrypt user data, helps to ensure credit card transactions are safe and secure.

Frequently Asked Questions

Routing numbers are nine-digit numbers that identify financial institutions. They are also called routing transit numbers or American Bankers Association (ABA) routing numbers.3

If you’re looking for your bank’s routing number, you can find it by checking your bank statement. Alternatively, you can look at one of your checks. The routing number is nine digits long and can usually be found in the left-hand corner.

The first number in the sequence identifies the payment network. This will be a 3 for American Express, 4 for Visa, 5 for Mastercard, and 6 for Discover). The numbers from one to six in the long number on the card identify the card payment network as well as the card issuer, sometimes called the issue identifier number (IIN). The remaining digits identify the cardholder.4

The Takeaway

Credit cards don’t have routing numbers because they don’t need them. Routing numbers are nine-digit relevant identifiers used by banks and other financial institutions for payments. Credit card numbers, on the other hand, contain information about the card issuer, payment network, and cardholder.

1 “Swift Code vs. Routing Number: What's the Difference?,” The Motley Fool

2,3 “Do Credit Cards Have Routing Numbers and Account Numbers?,” Upgraded Points

4 “Credit Card Numbers – What Do They Mean?,” Forbes

SHARE

Related Articles

How to Apply for Instant Approval Credit Cards

With an instant card number, you could start using your card instantly after approval. See how instant approval credit cards work.

How to Get a Credit Card

Looking to apply for a credit card? See how to get a credit card and factors to consider before applying for a credit card to make an informed decision.

What Is a Credit Card Number?

Credit card numbers may seem random, but each digit serves a specific purpose, like identifying the credit card issuer, the card network, and more.

The material made available for you on this website, Credit Intel, is for informational purposes only and intended for U.S. residents and is not intended to provide legal, tax or financial advice. If you have questions, please consult your own professional legal, tax and financial advisors.