How to Write a Check

5 Min Read | Last updated: September 15, 2025

This article contains general information and is not intended to provide information that is specific to American Express products and services. Similar products and services offered by different companies will have different features and you should always read about product details before acquiring any financial product.

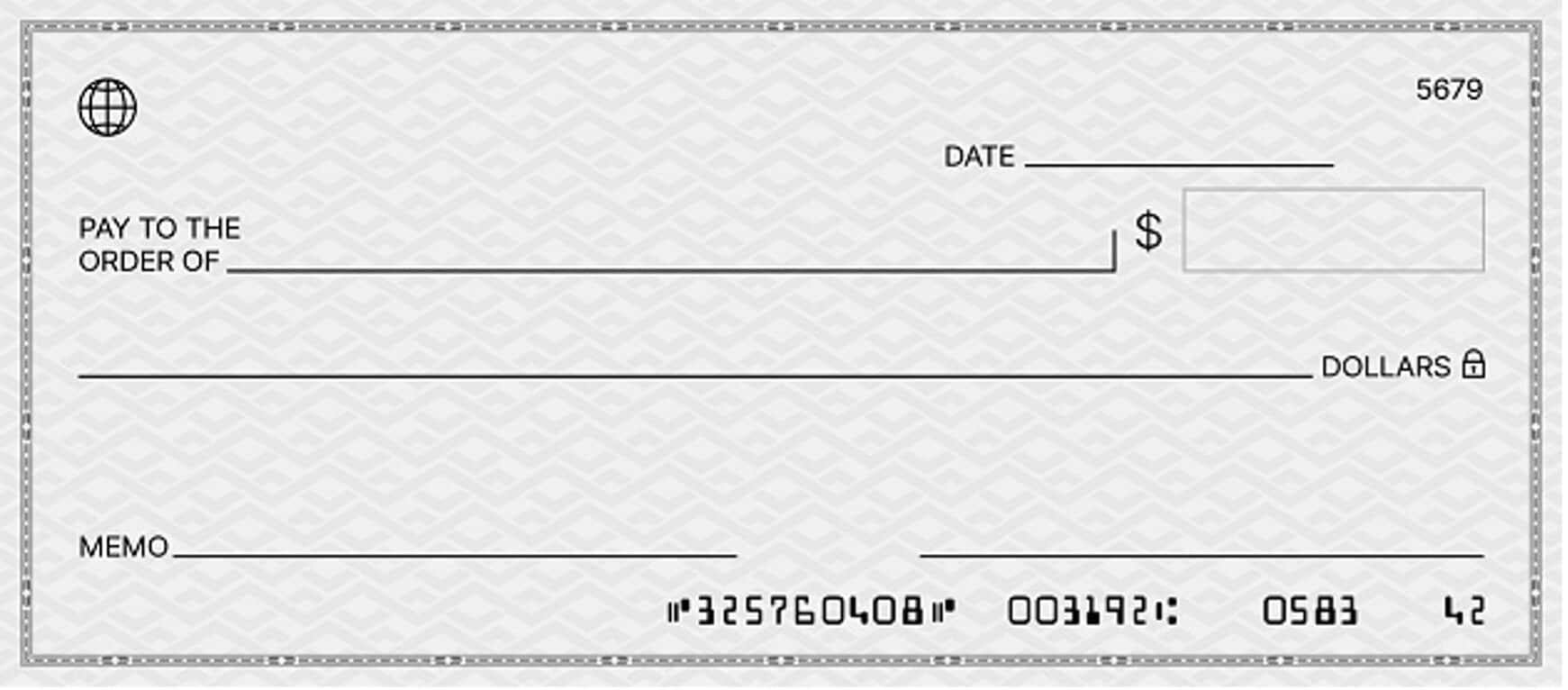

Learn how to write a check in six steps, including dating your check, writing in the payee, filling in the numerical amount, and writing out the amount.

At-A-Glance

- Properly writing out a check ensures your payments are made as you intended.

- Certain conventions are important to get right, like how to write out dollar amounts.

- Learning how to fill out a check can also help you reduce the risk of check fraud.

For a long time, writing a check was the standard way to pay many businesses or individuals. Fast forward to today where checks are used so seldomly that some people don’t know how to do it. Many Americans can swipe, chip, or click their way through most transactions.

While credit cards and other digital payment methods are faster, more secure, and more universally accepted than checks, there are still businesses that prefer them and so you’ll need to learn – or remember – how to write a personal check. Here are the six steps to properly write a check.

Step 1: Date Your Check

Every check needs to be dated, using the designated space in the upper right-hand corner. You need to write the month, date, and year in that space, either in words – October 25, 2023 – or numerals – 10/25/2023. Using the four-digit year may deter possible date tampering. Unlike electronic payments, the check date is not the date the recipient will be paid, but instead it starts the clock running for available payment. Six months after that written date, personal checks are considered “stale dated” and therefore void, though some banks or credit unions may honor the check after six months.1

However, take note: While it was once a common practice to “post-date” a check, using a future date to prevent someone from cashing the check before then, banks are not required to check the date, according to the Consumer Financial Protection Bureau. Some states require them to do so, but only when you notify the bank in advance not to cash a particular check until a certain date.2

Step 2: Write in the Payee

Every check has a preprinted line that begins “Pay to the Order of.” That’s where you’ll write in the name of the person or business you’re paying. Though straightforward, you may have to check on the exact payee name. Businesses may indicate who to make checks payable to on their invoices. The payee, or multiple payees, must endorse the check in order to present it for payment. If there are multiple payees, you’ll want to intentionally choose between “and” or “or” – in the first case, they all must sign but in the second only one is necessary.3

You can also write out a check to “Cash,” meaning anyone who has the check can immediately receive cash when they deposit it at the bank. But this can be risky, especially if the check falls into unintended hands.4

Step 3: Fill in the Numerical Amount of the Check

When writing a check, you’ll fill out the amount twice – once numerically and once in words. There is a box on the right side of the check, under the date, to write the amount of the check in numbers. It’s common for the box to have a pre-printed dollar sign ($), so you don’t need to write that. When writing out the amount, carry the number out to two decimals, using proper currency punctuation like commas and periods – for example, 1,234.00.

Check fraud happens sometimes. And when it does, it may be because the amount has been changed. To help avoid this, start your numerical amount up against the left-hand side of the box, and add a dash if there is leftover space in the box to the right of the numerals.

Step 4: Write Out the Amount of the Check in Words

Below the payee is a long line that ends with the pre-printed word “Dollars.” That’s where you will write out the amount of the check using words. It’s important to do this step correctly, because in the event there is some discrepancy between the numerical amount and the written amount, banking rules accept the written amount as correct.5

If you’re paying $100.50, start at the left side of the line and write “One hundred and 50/100.” If there are no cents, it’s still important to write “and no cents,” or “00/100,” for clarity. You don’t need to write the word “dollars” since it’s preprinted at the end of the line. Some additional examples:

- $220.75 is written as “Two hundred twenty and 75/100.”

- $1,000 is written as “One thousand and no cents” or “One thousand and 00/100.”

- $1,123.25 is written as “One thousand one hundred twenty-three and 25/100” or “Eleven hundred twenty-three and 25/100.”

- $0.95 is written as “Zero and 95/100.”

You may notice that the line for the written value is the longest one on the check, and you might need all that space. If you don’t, fill any leftover space with a dash that is as long as you need to reach the pre-printed word “Dollars” at the end.6

Step 5: Filling in the Memo Line is Optional When Writing Out a Check

In the bottom left-hand side of the check, you’ll find a blank line with the word “Memo” at the beginning. This space is optional, typically used to add a note to help the recipient know, or remind your future self, what the check is for, like “November rent” or “invoice #1234.”

A check is considered correctly written even with a blank memo line. Interestingly, the memo line is the only place on the front of a check where someone other than you may write something.6 Often, businesses will write in an invoice number on your memo line when they are processing your check.

Step 6: Signing the Check Is an Important Step

Banks are not required to honor an unsigned check, so this step is critically important.7 In fact, banks may flag them for potential fraud. Sign your check on the line at the bottom right using the form of your name that matches the name on your checking account, including middle initials or suffixes like “Jr.” for junior. Prefixes like Mr. or Ms. are not used.

On the flip side, an otherwise blank check that only has your signature gives the holder of that check unlimited access to funds in your checking account.6 So, signing should be the final step when writing a check, after all the other information has been completed.

Helpful Tips for Safe and Secure Check Writing

The tips below can help you confidently manage writing a check while minimizing potential security risks.

- Keep track of the checks you write: Some people keep track of checks in a check register or spreadsheet, noting the check number, amount, date, purpose, etc. If you prefer to manage banking on a mobile device, be sure to check your transaction history to ensure the checks you write are debited from your account in a timely manner. Either way, you’ll want to follow up to be certain your check reached the intended destination, especially if you sent it via mail.

- Write clearly: Banks may fail to process checks that are illegible, so it’s important to fill out each section of the check clearly and accurately.

- Double-check the details: Before you sign a check, be sure to double-check the date, amounts, and payee. If any of these fields are incorrect or blank, it could mean your money won’t get to the intended recipient in a timely manner or worse, it may open you up to check tampering.

- Use the right pen: Pencils or certain types of pens could be erased or washed off a check by a fraudster looking to change the payee or amount. Using a gel ink pen decreases the chances of someone else being able to tamper with what you’ve written.

- Dispose of old checks responsibly: Shred or otherwise destroy old checks before getting rid of them in the trash.

If you believe you’ve been the victim of check tampering or fraud, it’s important to let your bank know immediately and involve law enforcement if necessary.

The Takeaway

Knowing how to write a check is still important, even in this world of credit cards and digital wallets. Following these six steps will help you do it properly and safely.

1 “The bank/credit union refused to cash a check because it was more than six months old. Is this allowed?,” Consumer Financial Protection Bureau

2 “Can a bank or credit union cash a post-dated check before the date on the check?,” Consumer Financial Protection Bureau

3 “Do both my spouse and I have to sign the back of a check made out to us?,” Consumer Financial Protection Bureau

4 “Blank endorsement,” Cornell Law School Legal Information Institute

5 “I received a check where the words and the numbers for the amount are different. Is this check valid and for how much?,” Consumer Financial Protection Bureau

6 “How to Write a Check: A Step-by-Step Guide,” Experian

7 “I received a check that someone forgot to sign. Can I still cash it?,” Consumer Financial Protection Bureau

SHARE

Related Articles

Can You Buy a Money Order With a Credit Card?

Learn whether you can buy a money order with a credit card. See how to go about buying a money order and what you should know if you're planning to buy one.

Credit Score Myths vs. Facts

Myths persist about what a credit score is, how scores can be improved, and who can see them. It pays to separate fact from fiction.

What Is Debt Settlement?

Debt settlement can help you reduce debt. Learn how it works, how to negotiate debt settlement yourself, and the impact it could have on your credit score.

The material made available for you on this website, Credit Intel, is for informational purposes only and intended for U.S. residents and is not intended to provide legal, tax or financial advice. If you have questions, please consult your own professional legal, tax and financial advisors.