Disputes Learning Hub

American Express has your back with information, insights and solutions to help you prevent disputes and stay focused on your business.

Disputes Learning Hub

American Express has your back with information, insights and solutions to help you prevent disputes and stay focused on your business.

Understanding Disputes

In 2023, less than 0.035% of US Card Member transactions turned into Disputes that reached merchants.1

And what’s more…

There was an increase in the number of transactions made by American Express® US Card Members, but a decrease in the percentage of disputes that reach a merchant.2

Disputes 101

Learn about the types of disputes, tools and best practices to help you be ready if a dispute comes your way.

Disputes Reference Guides

Understanding the Disputes Process

Disputes Reference Guide

Videos

Common Dispute Prevention Tips

Video opens with the American Express logo and illustration of three common disputes and ways to help prevent them.

Voice over:

"We know disputes can be frustrating, so we're here with three common disputes and ways to help prevent them.

A No Knowledge Dispute happens when your customer doesn't recognize the transaction or your business name on a statement. To help avoid this, contact your processor to make sure your business name is accurate and familiar to your customers.

A Returned Dispute happens when your customer claims a product was returned but doesn't see a statement credit. If your customer returns an item, issue their credit within seven days. You should also prominently display your cancellation and return policies on all receipts and points of sale.

A Not Received Dispute occurs when your customer claims goods or services were never received. In the future, notify customers about any fulfillment delays, and wait to process charges until the items have shipped or until the service date.

To learn more on helping to manage and prevent disputes, visit AmericanExpress.com/US/DisputesManagement."

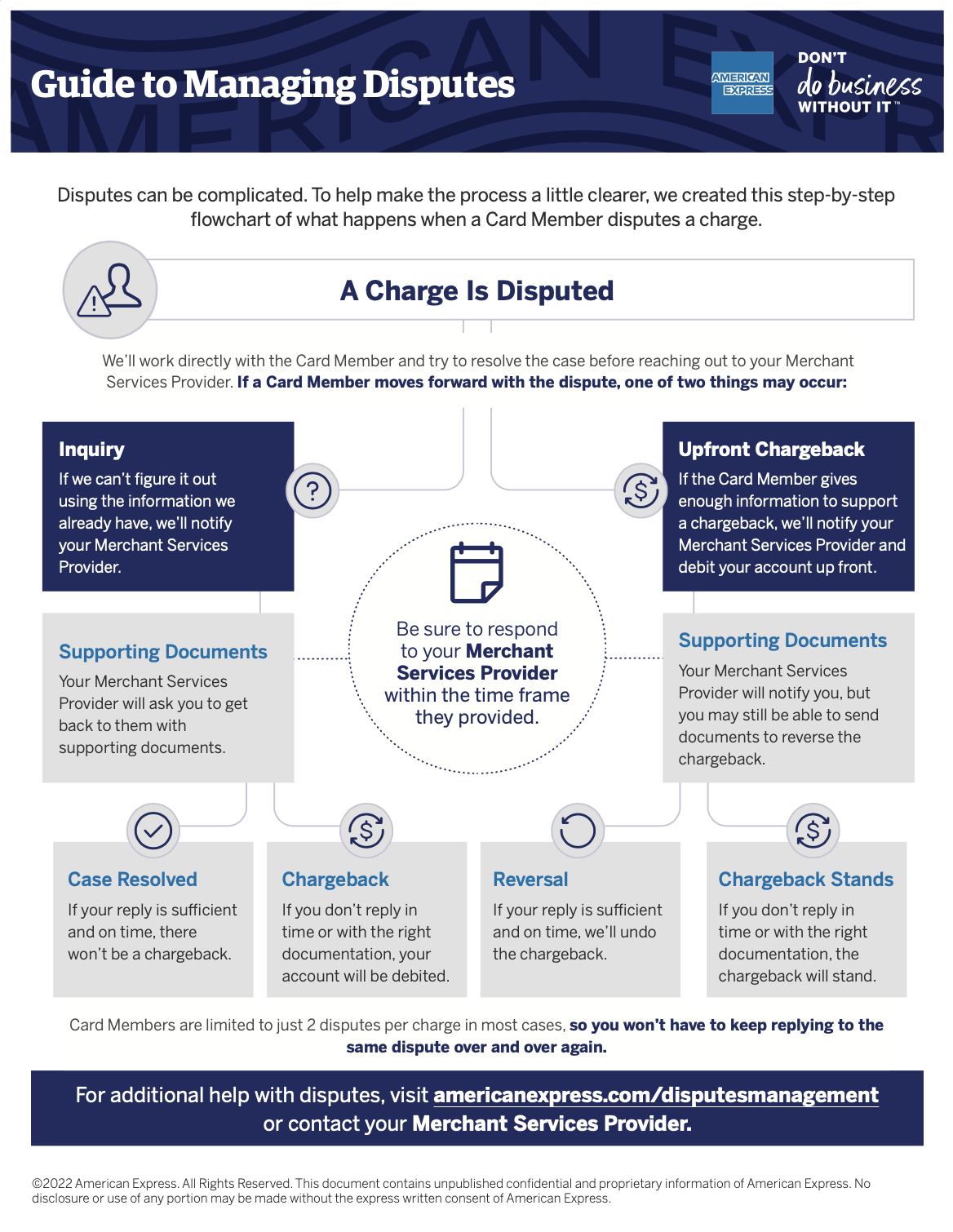

Understanding the Dispute Process

Video opens with the American Express logo and illustration of the Disputes process.

Voice over:

"Disputes can seem complicated, but we're here to help make the process clear. So here's what to expect if a charge is disputed.

First, we'll work directly with the Card Member, and can often clear up the dispute without having to contact you. If we must reach out to you, we’ll do so in one of two ways.

The first is an inquiry. If your Merchant Services Provider asks for your help, you'll need to respond with the requested information within the timeframe they provide. These inquiries have two potential outcomes. If you reply on time with sufficient information, there won't be a Chargeback. If you don't, your account will be debited.

The second way we reach out is an upfront Chargeback. This means if the Card Member provides enough information, we may debit your account. You'll then have to send information to your Merchant Services Provider that might reverse the Chargeback. If you reply on time with sufficient information, we'll issue a reversal. If you don't, the Chargeback will stand.

Go to AmericanExpress.com/US/DisputesManagement for more information on how to help stop disputes before they start."

Dispute Prevention Guides

From restaurants to hotels, different businesses have unique needs when it comes to processing transactions and helping prevent and manage disputes. Check out these resources to help you protect your unique business.

Presenting Compelling Evidence

For B2B Construction Merchants

Avoiding Dissatisfied/Not as Described Disputes

Preventing Disputes on Recurring Transactions

Avoiding Card-Not-Present Disputes

For Online Merchants

For Restaurants

For Hotels & Lodging

For Retailers

For B2B Merchants

AMEX Solutions

American Express is continually enhancing our solutions to help you prevent disputes.

Capabilities

Capabilities Video

Video opens with an illustration of American Express dispute capabilities.

Voice over:

"You’re in business to do business. And we’re here to help you if a potential dispute gets in your way.

In fact… in 2023, less than point-zero three five percent of US Card Member transactions turned into disputes that reached merchants. Here’s how we do it:

Substitute Receipts: If a customer raises a “does not recognize” dispute with American Express, we can create an itemized receipt without having to contact the merchant.

We can help resolve the issue alone 81.4% of the time for US Card Members, to potentially minimize interruptions to your business.

Digital Receipts: Customers reviewing Amex transactions online or on the app can simply click or tap to view a receipt. So if they have a question, they get an answer. Amex merchants that implemented digital receipts saw fewer disputes reach them than Amex merchants that did not implement digital receipts.

And finally, Authorization on Credit: If a customer makes a return, their refund is posted as pending in near-real-time on the Amex app. So they don’t have to call anyone to see that their pending refund is on the way.

Three American Express tools that get ahead of disputes before they cross your desk—just one more way we’ve got your back."

New! Authorization on Credit

Substitute Receipts – American Express helped resolve 90.4% of disputes raised by US Card Members as a “does not recognize” transaction with our Substitute Receipt capability without needing to contact merchants for help resolving the dispute.3

1 Internal American Express data comparing January – December 2023 vs January – December 2022.

2 Internal American Express data comparing January – December 2023 vs January – December 2022.

3 Data based on the success results of 887,417 Substitute Receipts sent to US Card Members for ‘Does Not Recognize’ disputes between January 1, 2021 and December 31, 2021. This capability is available for all American Express merchants.