Shop confidently with SafeKey®

An enhanced level of security when you use your Card online

Complete peace of mind when you shop online.

We want you to feel confident when you make a purchase with your American Express Card.

2

What do I have to do ?

SafeKey will work in the background as you make your purchase.

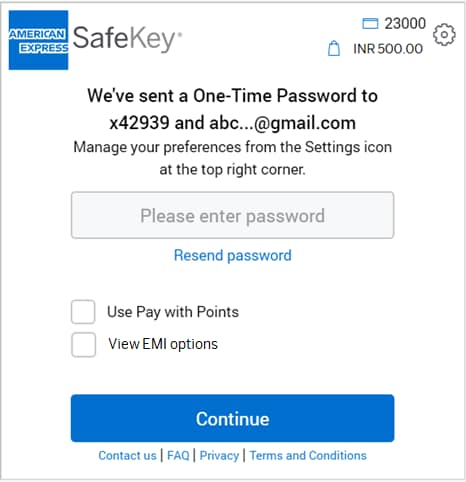

Once the SafeKey screen appears during an online transaction, we will instantly send you a six-digit

One Time Password (OTP) by text and/or email. Simply enter the OTP to

complete your transaction. You may select the 'Use Pay with Points' option to pay

using your Membership Rewards® points.

Or, we may send a push notification to your mobile device.

It is quicker and easier than receiving a OTP via an SMS or email,

but just as secure. All you need to do is download the Amex App and

enable Push notifications on your device.

You will have to confirm the purchase to complete the transaction.

Verifying via the push notification replaces the requirement of entering a OTP.

If you still prefer to receive an OTP via email or SMS, you can opt to do so from the

SafeKey screen that appears during the transaction.

You are automatically registered for SafeKey, Just ensure we have up to date

contact details for you and we'll take care of the rest.

Our intelligent security systems, secure payment process and fraud protection guarantee help keep you safe and secure. Find out more.

Use points with Safekey

From flights and hotel stays, to dining and electronics,

find out how to redeem your Membership Rewards®

points with SafeKey.

Equated Monthly Installments

(EMI)

Convert your online purchases into easy-to-manage EMIs with

SafeKey.

Simply choose the EMI option when prompted and enjoy

a more convenient way to pay.

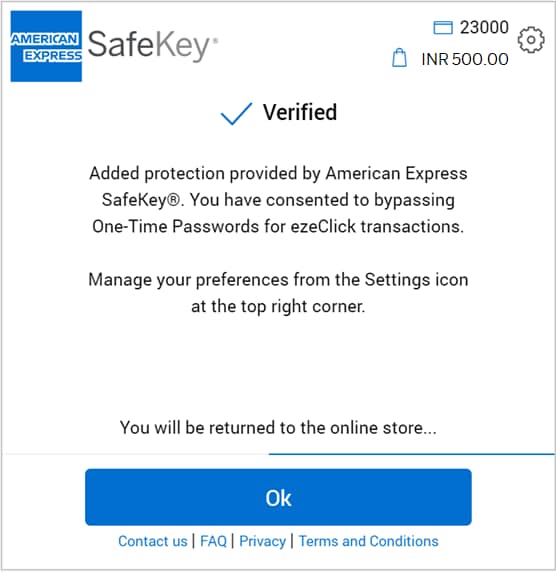

Faster online payments: ezeClick

Simply give your consent once and do away with OTPs for transactions upto INR 2,000 using American Express ezeClick.

You can change your preference by clicking on the Settings icon on the top right corner of the SafeKey screen.

Occasionally you may be prompted to enter an OTP for added verification.

American Express SafeKey helps prevent unauthorized online use of your American Express® Card by confirming your identity with additional verification information. You may be asked to provide a dynamic One Time Password (OTP) that you receive by email or at your mobile phone number for transactions you make with participating online merchants.

Yes, American Express provides online protection for all our customers through our internet Fraud Protection & Guarantee*. American Express SafeKey is launched as part of our continuous efforts to let our customers shop in a safer and more secure online environment.

*We will guarantee protection against fraudulent transactions on your Card, provided you have taken the responsibility to notify us immediately, and you have complied with your Card Terms & Conditions.

When you enter your American Express Card number for payment at a participating online merchant, an American Express SafeKey window will appear automatically. You will be prompted to enter your OTP which will be sent to your mobile phone and/or Email address that you have on file for that account. Once your OTP is verified, your online transaction will be processed. After the OTP is sent to you, it is valid for 10 minutes. If you do not enter the OTP and complete your transaction during the 10 minutes, you will need to restart the transaction with the merchant.

As an American Express Card Member , you get an option to do away with One Time Passwords for transactions upto INR 2,000 made via American Express ezeClick by sharing your consent. Thereafter , you only need to enter your ezeclick ID at a participating online merchant to process the online transaction. However on few occasions, for added security of your account, we may require you to enter an OTP. You may withdraw the consent by clicking the “Settings” icon at the top right corner of the SafeKey screen.

To know more about American Express ezeclick, visit www.ezeclick.com/amexezeclick/in/welcome

You are automatically enrolled for American Express SafeKey. There is no additional step that you need to take for your existing Cards, when you get new Cards, or when you open additional new accounts other than ensuring your mobile phone number and/or Email address on file with American Express is updated for all of your American Express Cards. Please ensure your mobile phone number and/or Email address is updated with American Express for all your American Express Cards. This also includes Supplementary Cards that you hold.

However in order to do away with OTPs for ezeClick transactions upto INR 2,000, you need to share your consent once on the SafeKey screen. You can choose to manage your consent preference by clicking the “Settings” icon at the top right corner of the SafeKey screen.

It is not mandatory for you to avail this facility. However if you wish to do away with OTPs for transactions upto INR 2,000, you need to provide your explicit consent, in accordance with RBI guidelines.

On your first SafeKey transaction you will see an overlay prompting you to provide your consent. In case you are not able to share the consent when prompted, you always have the option to share it by clicking the “Settings” icon at the top right corner of the SafeKey screen.

Please note that your consent will be saved only after the successful completion of the current SafeKey transaction by entering the OTP.

No, you only need to provide your consent once to waive off OTPs for transactions upto INR 2,000.

The waiver of OTPs for ezeClick transactions upto INR 2,000 will be effective for all your subsequent SafeKey transactions, post the consent has been captured.

The waiver of OTPs for transactions upto INR 2,000 is applicable only for transactions initiated using American Express ezeClick. You need to enter your ezeClick ID / American Express online account credentials to be eligible for a waiver of OTP. However on few occasions, for added security of your account, we may require you to enter an OTP. For transactions where you enter your card details while checking out online, you will always be asked to enter an OTP.

Yes, you can withdraw your consent if you wish to start receiving OTPs for your ezeclick transactions upto INR 2,000. You can withdraw your consent by clicking on the “Settings” icon at the top right corner of the SafeKey screen.

The consent preference will be changed only after successful completion of the current SafeKey transaction. Once your consent preference has changed, you will start receiving OTPs for your subsequent transactions.

No, you do not have to pay for this service. However, please check with your mobile and/or email service provider to see if charges for SMS or email apply to your mobile and/or email account.

You can proactively confirm the mobile phone number and Email address you have on file for all your American Express Cards by calling the helpline number mentioned on the back of your Card.

When you checkout with American Express SafeKey, the masked mobile phone number and Email address that we have attempted to send the OTP to are displayed. We will attempt to send the OTP to both your mobile phone and your Email address; if one is not updated you can use the other to obtain the OTP that was sent. If they are both not updated, please call the helpline number mentioned on the back of your Card.

We will use personal information collected through SafeKey for the purpose of providing the American Express SafeKey service (for example, to verify your identity or to authorize transactions). Log in to your account at www.americanexpress.co.in to view your personal details or make additional changes. Your personal information will be handled in accordance with our Online Privacy Statement.

The OTP helps to protect you against online fraud.

It is a secure way to authenticate that the customer using an American Express Card for an online purchase is the rightful owner.

Yes, you need to provide your mobile phone number or Email address to receive an OTP via SMS and/or Email. The SMS facility is only available for India mobile phone numbers. If you do not have an India mobile phone number, you can receive the OTP via Email only.

You can update your contact details by calling the helpline number mentioned on the back of your Card. Any updates you make to your contact details for your account alerts will automatically apply to SafeKey.

The OTP is valid for 10 minutes from when it was generated. If you do not enter the OTP and complete your transaction during the 10 minutes, you will need to restart the transaction with the merchant.

The OTP is valid for 10 minutes after it is generated by the transaction. If you click the “Resend Password” button within that 10 minute window, then the same OTP will be re-sent to you. If you click “Resend Password” button after the 10 minute window expires, then you will need to start the entire transaction process again which will generate a new OTP.

If the merchant is not American Express SafeKey compliant, you will not be asked for your OTP. Only American Express SafeKey merchant sites require the American Express SafeKey OTP. Also, in case you have given your consent for waiving off OTPs for ezeclick transactions upto INR 2,000, you may not be required to enter an OTP.

Participating online merchants will display the American Express SafeKey logo on their websites.

Yes, the account numbers for each Card are different and different contact details can be added for each primary, additional, and supplementary Card you have associated with your account. All that is needed is that the correct contact details be on file for each primary, additional, and supplementary Card.

No, each Card can have a different mobile phone number or Email address associated with it. If a mobile phone number or Email address has not been put on file for the additional and supplementary Cards, please update the details on file for the Cards as needed.

No, the contact detail update for the additional or supplementary Card will not change any details on file for the primary Card or other additional/supplementary Cards. It applies to the unique Card only.

If you ever suspect that fraudulent contact information changes or purchases have been made on your American Express Card account, please contact Customer Services immediately to report it by calling the helpline number mentioned on the back of your Card.

No, you can only use Cards issued by American Express Banking Corp., India excluding Business Travel Account (BTA) and Prepaid Cards.

A transaction could fail for various reasons. If you enter the OTP incorrectly access to SafeKey may be blocked. If the OTP wasn't entered within 10 minutes, the transaction will expire. Technical issues in the merchant's payment service could also interrupt the transaction. In each of these cases, you will receive an onscreen notification letting you know what went wrong. If you have any questions, you can always call the number on the back of your Card for help.

American Express will never email you to ask you for sensitive information. If you receive a suspicious email which claims to be from American Express, do not click on any links. If you have any questions, please call the number on the back of your Card.

You received a push notification instead of a One-Time Password because you have enabled push notifications from your Amex App. If you prefer to receive a One-Time Password on your registered email/SMS instead, you can turn off Amex App notifications from your mobile device settings. Alternately you can choose to receive an OTP via email/SMS on the SafeKey screen that appears during the transaction.

If you do not recognize the purchase details displayed in the Amex App, then please tap the “No, that’s not me” button that is available upon opening the notification. This will inform American Express that the purchase is not valid. Additionally, you may Contact Fraud protection at (91) 124 4190414 for more assistance.

Authentication via push notification is a new feature available to help protect your online purchases via SafeKey. You are being sent a push notification instead of an OTP because you have selected to enable push notifications from the Amex App on your mobile device.

The EMI option is still available (if eligible) post authentication via the Amex App. Simply complete the authentication and refer to the final SafeKey screen. Eligible transactions will display a check box allowing you to continue with EMI selection options.

The Pay with Points option is still available (if eligible) post authentication via the Amex App. Simply complete the authentication and refer to the final SafeKey screen. Eligible transactions will display a check box allowing you to continue with Pay with Points options.

At this time, not all transactions are eligible to complete authentication using the Amex App. Please ensure you have the Amex App installed on your primary device and have enabled push notifications via your device settings page.

American Express determines which transactions are eligible for authentication using a push notification. Please ensure you have the Amex App installed on your primary device and have enabled push notifications via your device settings page.

You will have to turn off push notifications on Amex App on your old device. Download the Amex App on your new device and enable push notifications on it from your device settings. Post this American Express will determine which transactions are eligible for authentication via a push notification and you will accordingly receive a notification. Until then you will receive an OTP via email or SMS, to verify your purchases.

Not an American Express® Cardmember yet?