Against the backdrop of growing economic concerns, only about half of US small business owners feel confident when making financial growth decisions, according to the Small Business Financial Confidence Report released by American Express.

Conducted in March 2023, the report sampled 550 US small businesses, ranging from fewer than 10 to 500 employees, segmenting responses by size. It tracked financial confidence, use of cash-flow tools, and sampled thoughts on key emerging trends, including AI and hiring tools.

The Small Business Financial Confidence Report identified small businesses’ confidence levels regarding various financial aspects of running a company. Responses showed that pricing, standing out against competitors, and product demand are top concerns of small-business financial decision makers.

The data also highlighted opportunities for improvement in cash flow confidence, with 41% of small business owners reporting that they ‘often’ or ‘always’ turn down potential opportunities because of their cash-flow position.

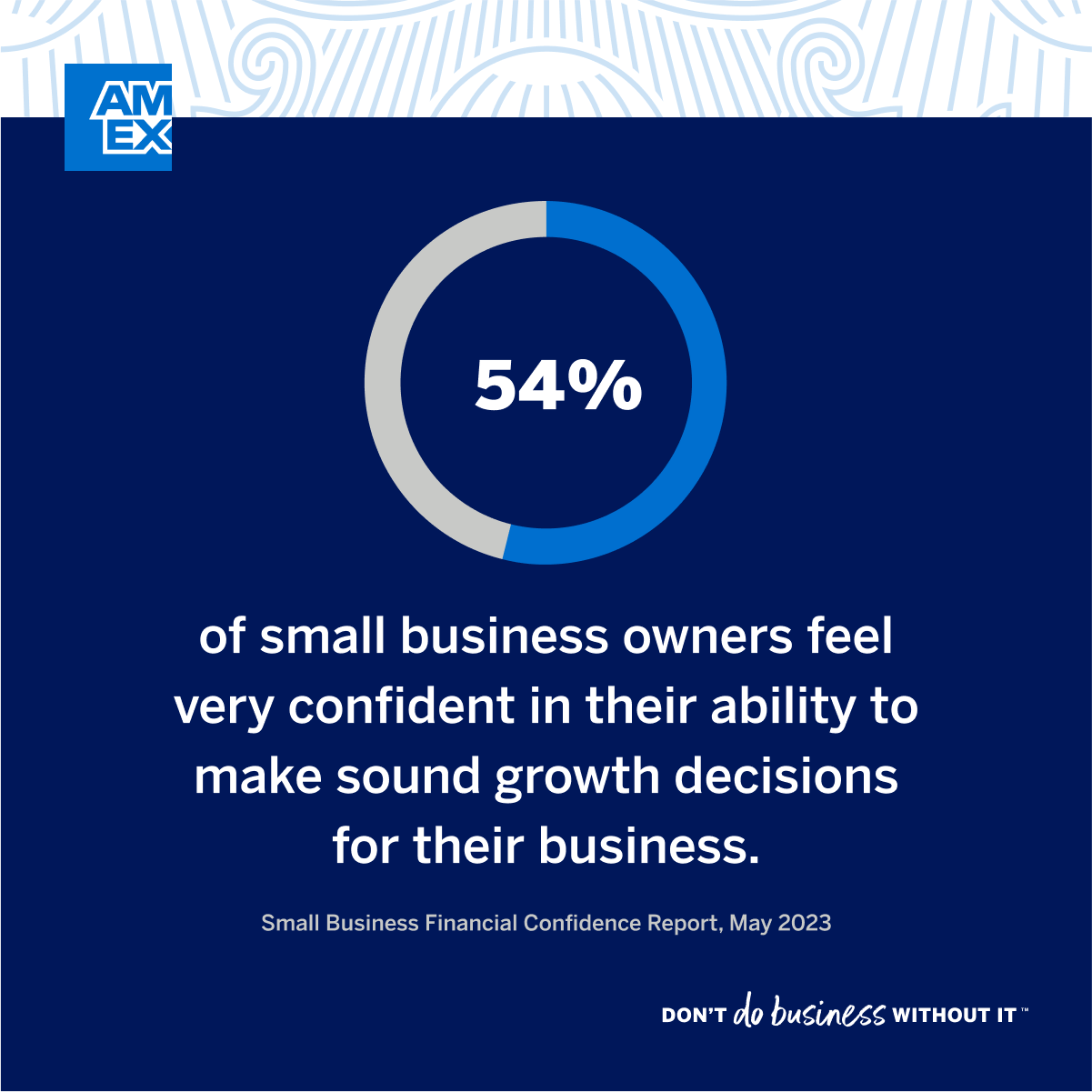

While the report found that just over half (54%) of small businesses surveyed feel “very confident in their ability to make sound growth decisions,” it revealed that larger small businesses feel better than their smaller counterparts: 64% of larger small businesses report feeling “very confident” while only 29% of smaller small businesses report the same.

The divergence by size also extends to how small businesses size up their competitors. Small businesses overall reported feeling “similarly or more prepared” to handle various business decisions as their competitors, but the smallest of the small businesses surveyed feel slightly less prepared than their larger counterparts.

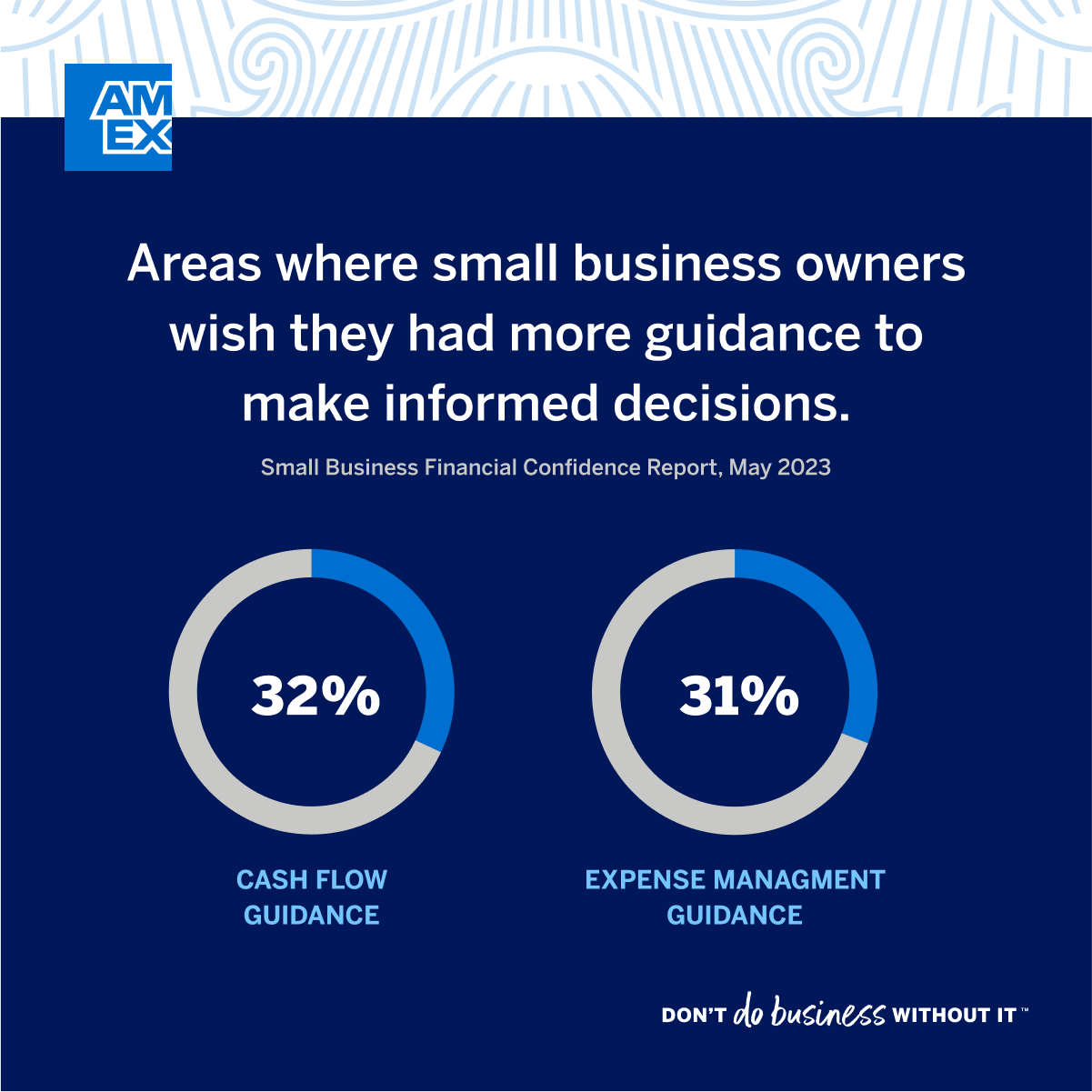

Cash-Flow Tools Are Critical, But Business Owners Seek More Guidance

In addition to overall confidence, the survey investigated small business owners’ relationships with cash-flow management tools. The report found that 72% of small business owners report using either one or two cash-flow management tools to run their business, and 69% wish that their bank or financial company offered more tool integration.

Small businesses identified intuitive spreadsheet integrations with other platforms, customizable dashboards, and access to cash-flow planning templates as their most-wanted integrations and resources. And for many small-business owners, like Haydn Bratt, founder and partner at Mindset Leadership, critical insights revealed from integrations like these have the power to unlock sharper decision-making and ultimately, better business.

“By staying on top of cash flow and other key metrics, we know where we can invest, what aspects of the business need further attention and focus, and we get an up-to-date view of the health of the business so that we can make in-the-moment decisions rather than waiting for the EOY accounts,” says Bratt. He uses two tracking documents that, alongside their accounting software, give him a real-time view of how the business is performing.

Adds Bratt, “We use a business plan tool that provides us a weekly view of how our numbers are tracking against these key metrics as well as the product mix in our business.”

Small-Business Trends: Hiring and AI

The survey also asked business owners to offer their perspective on two key emerging trends: hiring and AI.

Regarding hiring trends, the survey found:

- About 50% of all small businesses are currently hiring, with larger more likely to be hiring than smaller small businesses.

- The main reason for hiring is the need for employees, yet large and medium small businesses are twice as likely to be hiring due to financial growth than smaller businesses.

- More than half of all small businesses are “very confident” in knowing when their business can afford to hire, how many people to hire, and the right time to hire.

- The most common hiring tools used by small businesses are online job postings and social media recruiting.

- Hiring difficulties, including spending too much time interviewing, are common across the board.

The survey also found that many small-business owners spend a great amount of time on various business tasks. For example, “small businesses report spending the most time on financial and administrative tasks while running their businesses.”

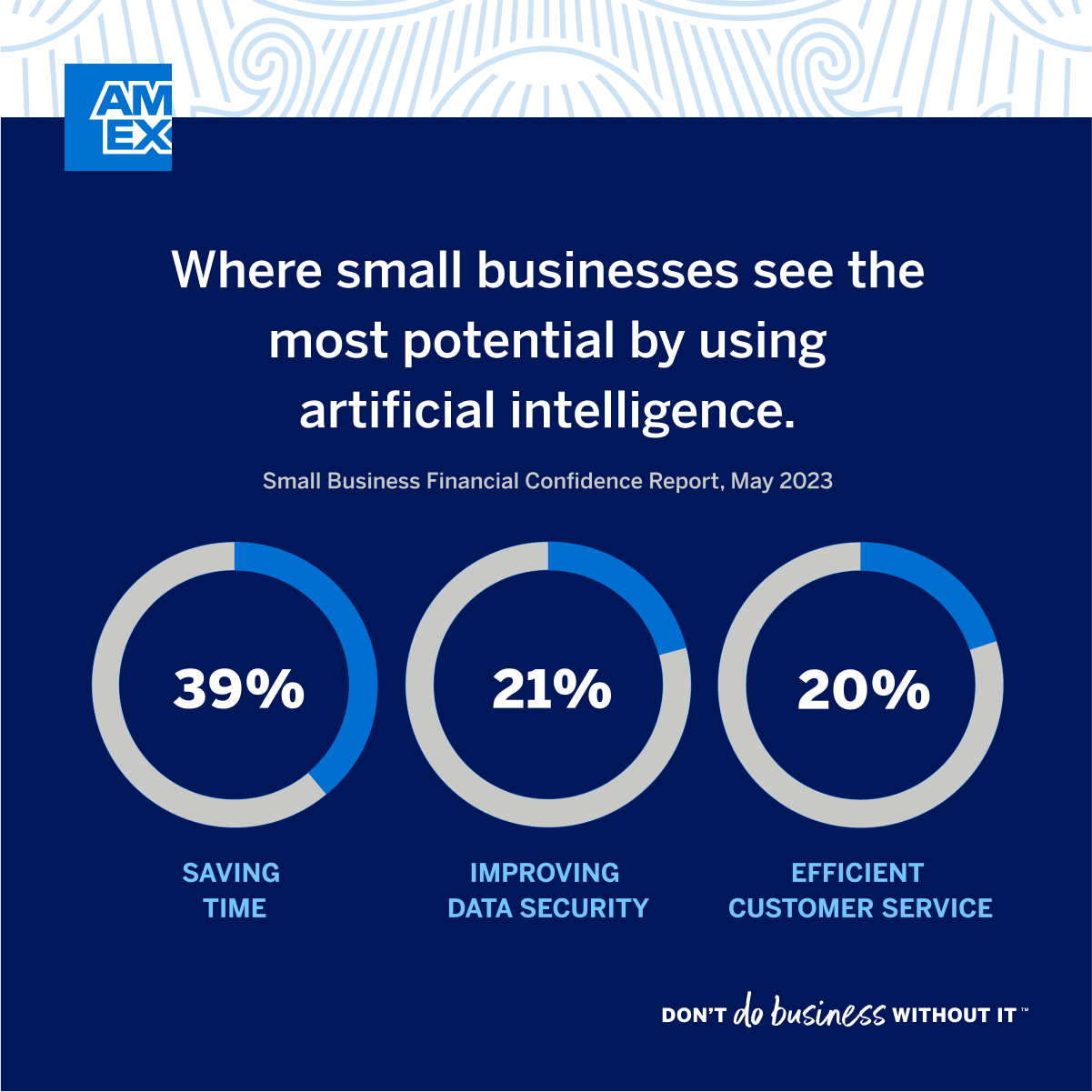

In response, many small-business owners have turned to AI to save time with tasks such as improving data security and providing more efficient customer service. However, the report also found that uncertainty is among the top deterrents keeping small businesses from using AI in business.

Some key survey data regarding the use of AI in business includes:

- About 2-in-5 small businesses (41%) report that their business is currently prioritizing artificial intelligence to help make business decisions, while almost double that among the large small businesses.

- More than half of all small businesses surveyed are using AI in business, especially when it comes to customer service.

- Of those who are not currently prioritizing artificial intelligence, almost 2-in-3 (65%) say they would consider or would maybe consider using AI in the future.

Small-Business Hiring Depends on Size

The survey found that about half of all small businesses surveyed are currently hiring, though the smallest small businesses are much less likely to be bringing on new employees than the largest small businesses. Key reasons for hiring include the need for employees, as current employees require additional support. Other reasons include requiring a new skill set and strong company growth.

Reasons for the smallest group discontinuing hiring include a limited hiring budget, slow or stagnant growth, and a lack of personnel to hire and manage new employees. Regarding the latter, the survey found that almost 1-in-4 small businesses have had difficulties hiring and have spent too much time on interviewing.

When it is time to hire, the survey found that a little more than half of small businesses surveyed are “very confident” in knowing when their business can afford to hire, how many people to hire, and the right time to hire. Online job postings and social media recruiting are the most common hiring tools used by small businesses. However, almost half of the smallest small businesses say they don’t currently use any tools for hiring.

Christena Garduno CEO of Media Culture, a brand response marketing company, has found that hiring top talent is vital to her company’s continued success. To facilitate doing so, she recruits using AI hiring technologies, which she has found expedites the process considerably.

“AI tools are revolutionizing how businesses make strategic decisions and sustain growth in today's competitive market,” says Garduno. “Using AI, my company evaluates massive volumes of data, discovers patterns, and extracts meaningful insights. This enables me to make confident financial decisions to analyze and control expenditures, weather economic turbulence, pivot as appropriate, and compete with my peers.”

“These technologies aid us in effectively automating applicant screening, analyzing abilities, and selecting the best-fit prospects,” says Garduno. AI recruiting technologies have helped my company establish a competent and diverse team by saving time and enhancing applicant assessment.”

How Small-Businesses Are Leveraging Artificial Intelligence

Given the fact that small business owners report spending the most time on financial and administrative tasks while running their businesses, it isn’t surprising that an increasing number of small business owners are incorporating the use of AI.

"I feel very confident in my ability to make informed decisions about my company's financial future thanks to AI data"

—David Zhang, CEO, Kate Backdrop

According to the survey, “About 2-in-5 small businesses (41%) report that their business is currently prioritizing artificial intelligence to help make business decisions. And more than half of all small business owners use artificial intelligence to help run their business, especially when it comes to customer service.” Of those not currently prioritizing artificial intelligence, almost 2-in-3 (65%) say they would consider or would maybe consider using AI in the future.

Small businesses surveyed report seeing potential emerge in AI in saving time, improving data security, and providing better customer service. This is the case for Kamil Faizi’s business, Challenge Coins 4 U, which produces custom challenge coins, promotional items, and lapel pins.

“My business must stay on top of customer trends and preferences, and provide exceptional customer service,” says Faizi. “To achieve this, I rely on AI tools that help me gather and analyze vast amounts of data. These tools provide valuable insights into customer behavior, predict trends, and personalize their experiences. AI-powered analytics platforms, customer relationship management systems, and chatbots are some examples that enhance our company’s customer interactions.”

Bratt of Mindset Leadership regularly uses AI to enhance his customer service efforts. “We frequently review our ideal client persona using ChatGPT as a research tool,” he says. “Asking questions regarding what is happening with our ideal client and what they are concerned about and searching for right now helps us to stay focused on what is on customers' minds. We then consider that information when producing and developing products and services and in our messaging and marketing.”

How Small Businesses Use AI to Unlock Better Decision-Making

David Zhang, CEO of Kate Backdrop, which sells event and photo backdrops, is optimistic about his financial decisions thanks to the use of AI tools that provide him with vital information.

“I feel very confident in my ability to make informed decisions about my company's financial future thanks to AI data,” says Zhang. “By analyzing customer trends and preferences in real-time, I can make more informed decisions about pricing, marketing strategies, and product offerings, which allows the company to stand out against competitors, deal effectively with pricing and price hikes, and weather economic volatility.”

Before using AI-powered tools, most of Zhang’s financial decisions were made based on manual data analysis. “Our marketing team had to track customer trends and preferences manually. This was time-consuming and often inaccurate,” he says.

“The introduction of AI-powered tools has empowered financial decisions,” continues Zhang.

“We have been able to make data-driven decisions with more accuracy and confidence, identifying areas for cost savings and potential growth opportunities faster than ever.”

The Future Is Bright for AI in Business

As the report found, using AI in business for key tasks such as decision making, data security, customer service, and hiring is increasingly becoming more common for companies of all sizes. With artificial intelligence technology continuing to improve and small-business owners finding AI assistance increasingly helpful, more and more businesses will likely adopt AI in the future.