A business has many reasons to know its profitability. Internally, business leaders regularly look for areas to improve on, and rising or falling profits tell them how they’re doing. Externally, investors and lenders need to understand the health of a company before trusting it with their cash. Typically, the first place they all look is the bottom line – net profit and net profit margin. As crucial as it is, however, the “kitchen sink” nature of net profit margin usually requires a bit of unpacking before the true picture of a business’s financial strengths and weaknesses can emerge.

Net Profit Defined

A business’s net profit, or net income, is the profit left after all expenses have been paid; it shows the overall profitability for a given period. The emphasis on “all” is noteworthy because net profit is calculated as total revenue minus total expenses for the period. Unlike gross profit and operating profit, which are interim steps on a multistep income statement, net income reflects the entire range of business activities. That means not only revenue and the expenses involved in producing the revenue, like cost of goods sold (COGS) and operating expenses such as salaries and rent, but also nonoperating activity, like investment gains and losses, interest payments, and taxes.

Net income is usually found at the bottom of a company’s income statement – literally “the bottom line” – which companies may generate yearly, quarterly, and sometimes monthly. It represents the profit that is available to be distributed to owners or reinvested in the business.

What Is a “Good” Net Profit Margin?

Net profit margin is simply a company’s net income, or bottom line, expressed as a percentage of the business’s top line, or total revenue. That’s why it’s such an important overall measure of business success. What constitutes a good profit margin can vary widely from industry to industry.

Because different industries have many diverse variables, especially when it comes to their level of competitiveness, they end up with different profit margins on the goods or services they provide. So, they have varying measures of what constitutes a “good” net profit margin. Because of this disparity, it’s important for businesses to compare themselves with direct competitors, or at least with companies in similar markets, to discern whether their net profit margin is strong.

How to Calculate Net Profit Margin

Use this formula to calculate net profit margin:

Net Profit Margin = Total Revenue – COGS – Operating Expenses – Nonoperating Expenses ( x 100 )

Total Revenue

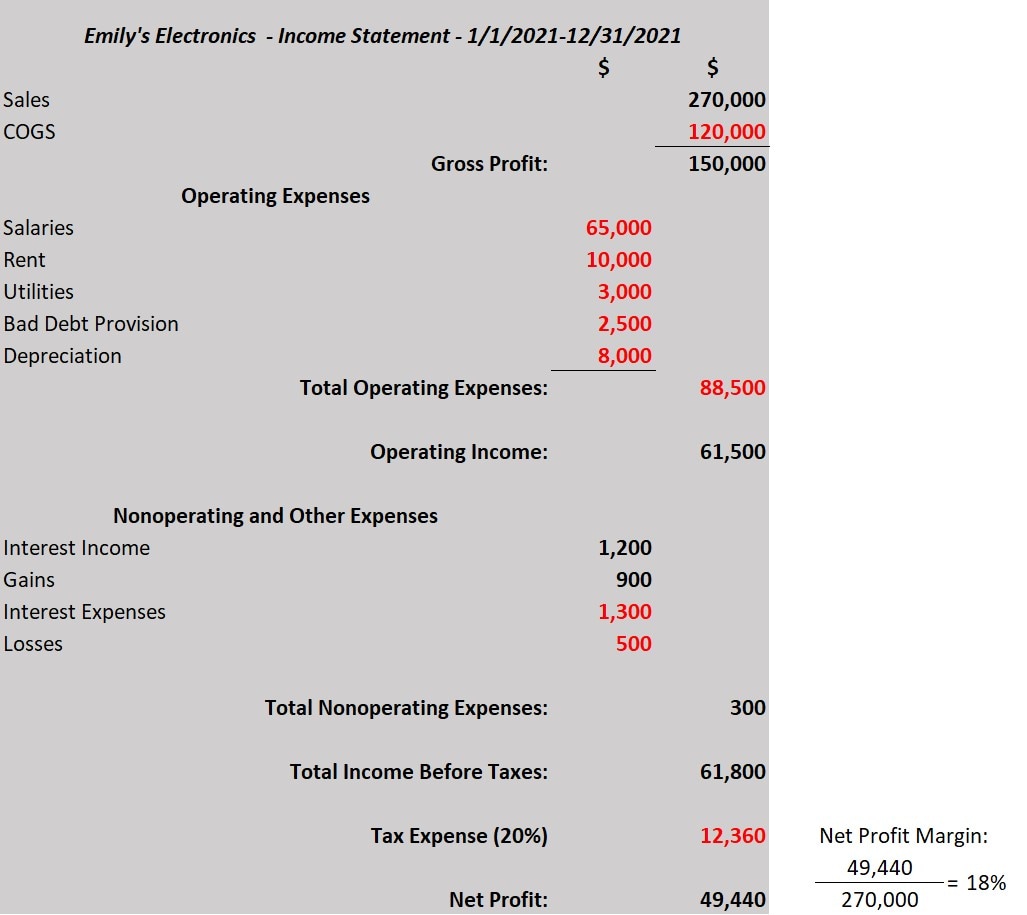

The net profit and net profit margin for a hypothetical business named Emily’s Electronics can be found on the bottom line of the theoretical income statement shown below. In it, Emily’s Electronics had revenue of $270,000 for full-year 2021 and spent $120,000 on COGS and $88,500 on operating expenses. Additionally, the statement shows multiple nonoperating gains and losses that net out to a $300 gain, which doesn’t have much financial impact and, therefore, doesn’t obscure the picture of the business’s core profitability. The rightmost column shows the running totals as expenses are deducted from top-line revenue, until reaching pretax income of $61,800. Subtracting an estimated 20% for taxes ($12,360) leaves Emily’s Electronics with a net income of $49,440, which, when divided by total sales/revenue of $270,000, yields a net profit margin of 18.3%.

Why Net Profit Is Important

Business managers, investors, and lenders look at net profit first to determine a company’s financial health before diving into more specifics. For public companies, net income per outstanding share of stock, also called earnings per share, is a key ratio for many investors. Internally, net profit margin is used for many analyses and calculations. For example, executive compensation and bonuses are often tied to achieving certain net profit goals, either in terms of specific dollar values or growth levels. It’s also used in financial modeling. For example, businesses considering a change, like opening another location, switching suppliers, or restructuring corporate offices, might model out how those changes would affect the bottom line, both in the short term and the long term.

Unlike gross profit and operating profit, which are interim steps on a multistep income statement, net income reflects the entire range of business activities.

Net income may also be part of a business’s debt covenants – rules borrowers must follow or risk defaulting on their loans – as some lenders may specify, for example, that net profit or margin must not fall below an agreed-upon level. Last but not least, net income is often viewed over periods of time to identify upward or downward trends in a business’s financial health.

But because net profit margin is one of the broadest measures of a company, business managers and other stakeholders looking for more depth and nuance often analyze gross profit and operating profit metrics, too.

What to Know About Net Profit and Quality of Earnings

Because net profit includes every type of revenue and expense that a company generates, nonrecurring losses and gains can influence it. If you look at net profit in isolation, the impact of nonoperating activity can make it appear that a real shift occurred even when the company’s core business hasn’t really changed. This is what investment analysts call evaluating the “quality of earnings” to understand the real drivers behind a company’s bottom line number.

For example, if a company goes through a lawsuit and must pay a large settlement, that could reduce its net profit margin for that quarter despite sales, productivity, output, and gross profits remaining stable. Failure to properly contextualize a weaker or stronger net profit with other metrics, like gross profit and operating profit, can cloud the true picture of a business’s strengths and weaknesses. Similarly, a business looking to attract investors can use other metrics alongside net profits to show a more complete picture of a business’s operations, especially when nonoperational losses are temporarily dragging down the bottom line.

It’s also important to note that net income does not reflect a business’s cash flow. A business’s high profits from sales may not translate quickly enough into the cash needed to meet obligations like payroll and rent if the organization has a slow accounts receivable process or customers who can’t pay. This is another reason why net income is only a piece of the puzzle needed to fully understand a business’s financial health.

The Takeaway

Net profit margin is a valuable tool for a business looking to compare its overall expenses with its revenue. It is often used as an initial figure for differentiating a company’s strength against that of competitors in similar industries, by both internal analysts looking to make improvements and external investors and lenders determining the value of a share or the riskiness of a loan. Net profit margins do have limitations, however, as nonrecurring gains/losses and ancillary activity can affect them. Analysts and investors often look at net profit margin as a point in a trend line, and study them alongside other measures, like gross margins and operating margins.

Photo: Getty Images