Professional benefits and everyday Membership perks – that’s the power of American Express® Corporate Cards

With your Corporate Card, you can unlock professional benefits that may enhance your everyday

Professional & Everyday Benefits

Your Corporate Card comes with benefits designed to help enhance your business travel and entertainment experiences — and unlocks value that extends beyond business hours.

Access More with Membership

Enjoy special ticket access to some of the biggest games, concerts, shows, and more year round.‡

While supplies last, not all seats may be offered.

Get the most from your

Corporate Card with the

Membership Rewards® program‡

How it works

Put eligible business expenses — like flights, client dinners, or office supplies — on your Corporate Card and earn Membership Rewards® points on the purchases that keep business moving.

Use points your way

Redeem points for what matters most to you:

- Gift cards at over 75 brands

- Use Pay with Points at checkout at some of your favorite retailers

- Future travel plans with Amex Travel™‡, except for Insider Fares which must be covered entirely with points‡

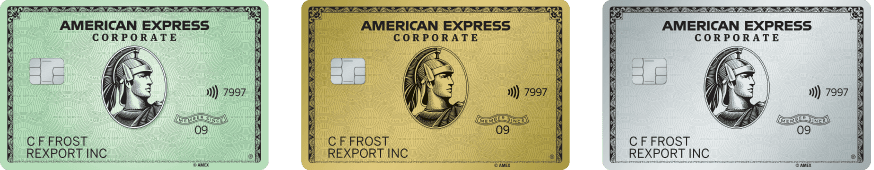

Eligibility* & Enrollment

Corporate Green Card Members

To start earning Membership Rewards® points, call 1-800-528-2112 to

confirm your eligibility and enroll. A $55 annual fee applies, which may be

covered by your company.**

Corporate Gold and Platinum Card Members

Eligible Corporate Gold and Platinum Card Members are automatically enrolled in the Membership Rewards® program. Explore your Membership Rewards®

Dashboard to view the points you've earned and see how these points can add up.

*Eligibility determined by your employer.

**Be sure to refer to your company's internal policy for guidance.

Get to know your American Express® Corporate Card

‡Terms and Conditions

Amex Presale Tickets® (formerly referred to as American Express Early Access)

American Express® Card Members have access to purchase Amex Presale Tickets® for select events and select seats, during a specified period prior to the general on-sale dates for those events. Tickets must be purchased using an American Express Card. An American Express Prepaid Card cannot be used to purchase tickets. Amex Presale Tickets® are sold by and fulfilled by third party ticket sellers (not American Express), and such tickets are subject to the rules, terms and conditions, prices and fees set by the ticket seller, event promoter and/or the venue. Amex Presale Tickets® are subject to availability and supply may be limited. Not all seats may be offered; purchase limits and blackout dates may apply. Refunds, exchanges, and resale may be prohibited by the ticket seller. For more information, please visit americanexpress.com/entertainment.

Amex Reserved Tickets® (formerly referred to as American Express Access)

American Express® Card Members have access to purchase Amex Reserved Tickets® for select events and select seats, during a specified period. Tickets must be purchased using an American Express Card. An American Express Prepaid Card cannot be used to purchase tickets. Amex Reserved Tickets® are sold by and fulfilled by third-party ticket sellers (not American Express), and such tickets are subject to the rules, terms and conditions, prices and fees set by the ticket seller, event promoter and/or the venue. Amex Reserved Tickets® are subject to availability and supply may be limited. Not all seats may be offered; purchase limits and blackout dates may apply. Refunds, exchanges, and resale may be prohibited by the ticket seller. For more information, please visit americanexpress.com/entertainment.

Individual Membership Rewards® Program

Enrollment in the Membership Rewards® program is required. The American Express® Corporate Green Card and the Global Dollar Card - American Express® Corporate Green Card is charged a $55 annual enrollment fee. A program fee is not applied for the American Express® Corporate Gold Card, American Express Corporate Platinum Card®, Global Dollar Card - American Express Corporate Platinum Card®, and Global Dollar Card - American Express® Corporate Executive Gold Card. Some Corporate Cards are not eligible for enrollment. For a full list of eligible Corporate Cards, please see the full Membership Rewards Terms and Conditions. Card Member eligibility for enrollment is based upon the company’s participation in the Membership Rewards program. Employees with Corporate Green Cards selected to earn individual Membership Rewards must call the number on the back of their Card to complete enrollment. Enrolled Corporate Card Members get one Membership Rewards point for every dollar of eligible purchases charged on enrolled Corporate Green Cards, Corporate Gold Cards, and Corporate Platinum Cards®. Eligible purchases are purchases for goods and services minus returns and other credits. Eligible purchases do NOT include fees or interest charges, cash advances, purchases of travelers checks, purchases or reloading of prepaid cards, or purchases of other cash equivalents.

Terms and Conditions for the Membership Rewards® program apply. Visit membershiprewards.com/terms for more information. Participating partners and available rewards are subject to change without notice.

The value of Membership Rewards points varies according to how you choose to use them. To learn more, go to www.membershiprewards.com/pointsinfo.

Membership Rewards® Pay with Points at AmexTravel.com

To use Pay with Points, you must charge your eligible purchase through American Express Travel to a Membership Rewards® program-enrolled American Express® Card. Eligible purchases through American Express Travel exclude non-prepaid car rentals and non-prepaid hotels. Points will be debited from your Membership Rewards account, and credit for corresponding dollar amount will be issued to the American Express Card account used. If points redeemed do not cover entire amount, the balance of purchase price will remain on the American Express Card account. Minimum redemption 5,000 points.

See membershiprewards.com/terms for the Membership Rewards program terms and conditions.

If your Card is eligible for Pay Over Time and if a charge for a purchase is included in a Pay Over Time balance on your Linked Account, the statement credit associated with that charge may not be applied to that Pay Over Time balance. Instead the statement credit may be applied to your Pay in Full balance. If you believe this has occurred, please contact us by calling the number on the back of your Card. Corporate Card Members are not eligible for Pay Over Time.

Seller of Travel

American Express Travel Related Services Company, Inc. is acting solely as a sales agent for travel suppliers and is not responsible for the actions or inactions of such suppliers. Certain suppliers pay us commission and other incentives for reaching sales targets or other goals and may provide incentives to our Travel Consultants. For more information visit www.americanexpress.com/travelterms.

California CST#1022318; Washington UBI#600-469-694

Insider Fares

Insider Fares are valid only for Membership Rewards® program-enrolled Cards when a Card Member is booking through AmexTravel.com. Insider Fares will display in search results on AmexTravel.com only if an eligible Card Member is logged into his/her account and has enough Membership Rewards points for the entire fare; otherwise, publicly available fares will display. Insider Fares are fares for which less Membership Rewards points are required to purchase the flight. The entire amount of the purchase must be covered using Membership Rewards points. Insider Fares are only available on select flights. When purchasing an Insider Fare, the dollar amount of the fare will be charged to the Card Member’s account and a credit will be issued in that dollar amount on the Card Member’s statement; additionally, the number of Membership Rewards points required for the fare will be deducted from the Card Member’s Membership Rewards account balance. Participating airlines and benefits are subject to change. For more information about the Membership Rewards program visit www.membershiprewards.com/terms.