What's in this article?

3 Min Read | Published: December 12, 2023 | Updated: April 1, 2025

How to link a bank account to American Express Business BlueprintTM

When you link external bank accounts to Business Blueprint, those accounts are then included in your cash flow insights and available to use for your American Express® Business Line of Credit.

The following guide will walk you through the process to link bank accounts.

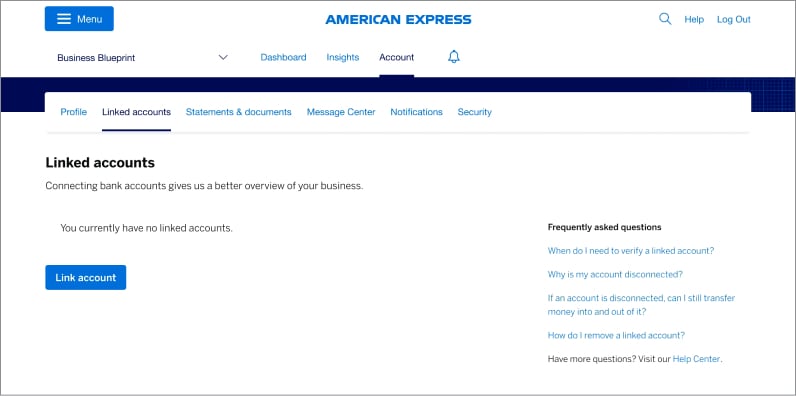

After logging into your Business Blueprint dashboard, click on “Account”.

Then, select the “Linked Accounts” tab to see a list of accounts you currently have linked to Business Blueprint.

For illustrative purposes only

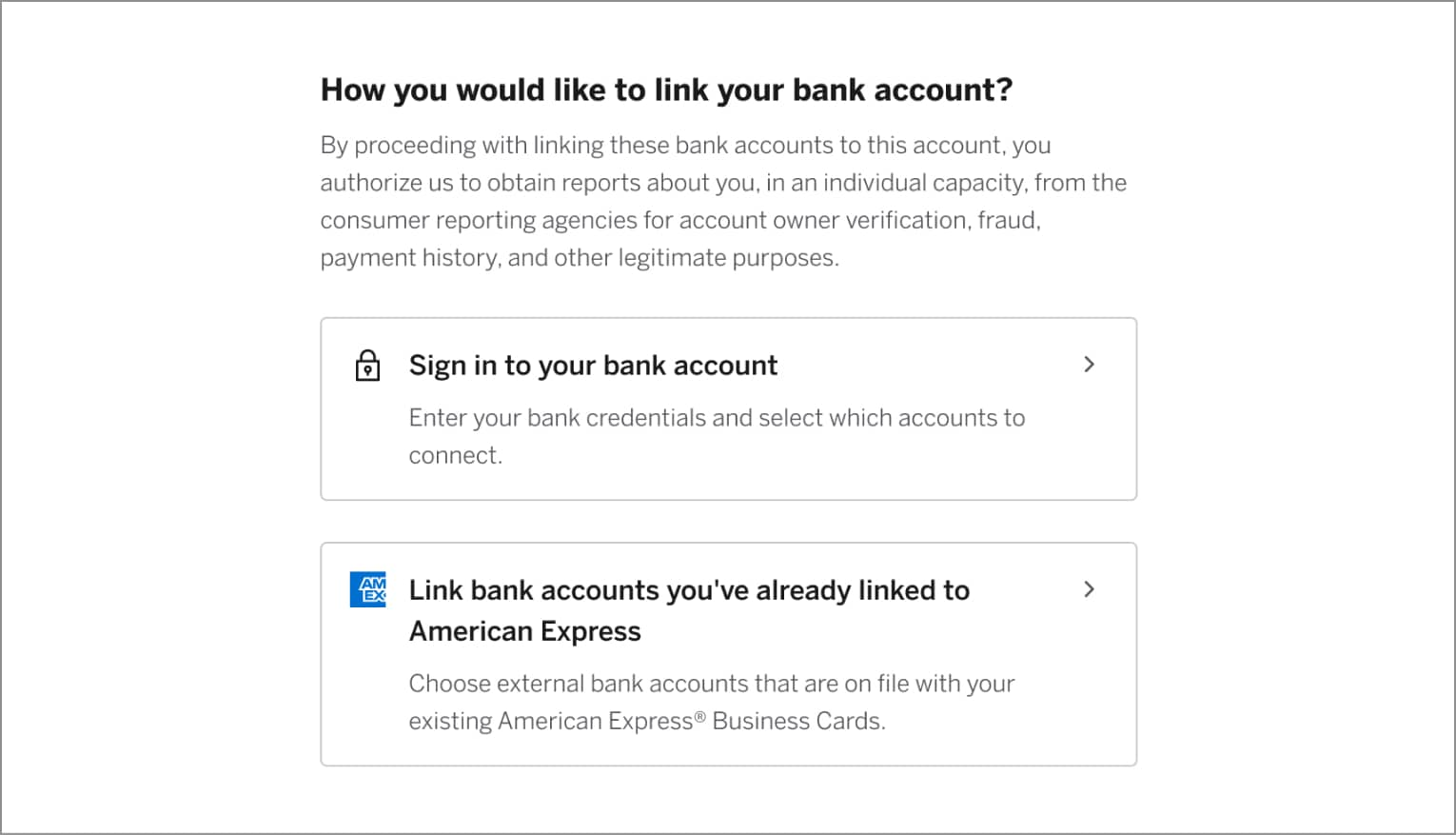

You may have two different options to link an account: You can link a new bank account, or link an account already associated with your American Express® Business Cards.

Step 3: Link a new account.

On the next screen, you will see a list of some commonly linked banks.

If your bank is not shown, simply use the search bar at the top to enter in the name, URL, or routing number of the bank you’d like to link.

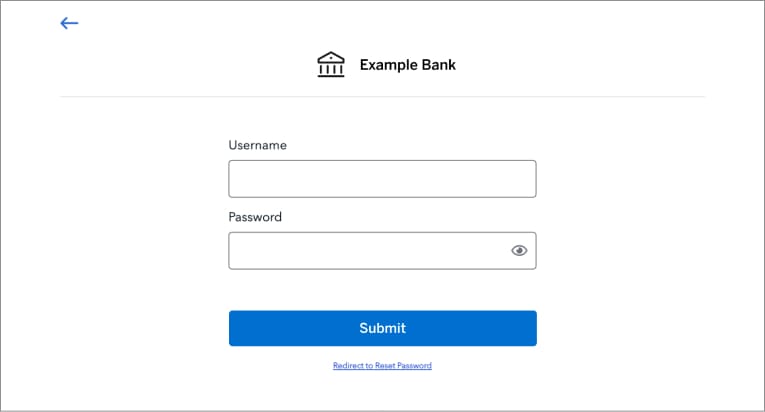

Step 4: Sign into your bank and choose accounts.

After selecting your bank, you will be required to sign in using the username and password for that account. Your bank may ask additional security questions to verify your identity.

NOTE: Your information is kept confidential, and American Express does not store your

login credentials.

For illustrative purposes only

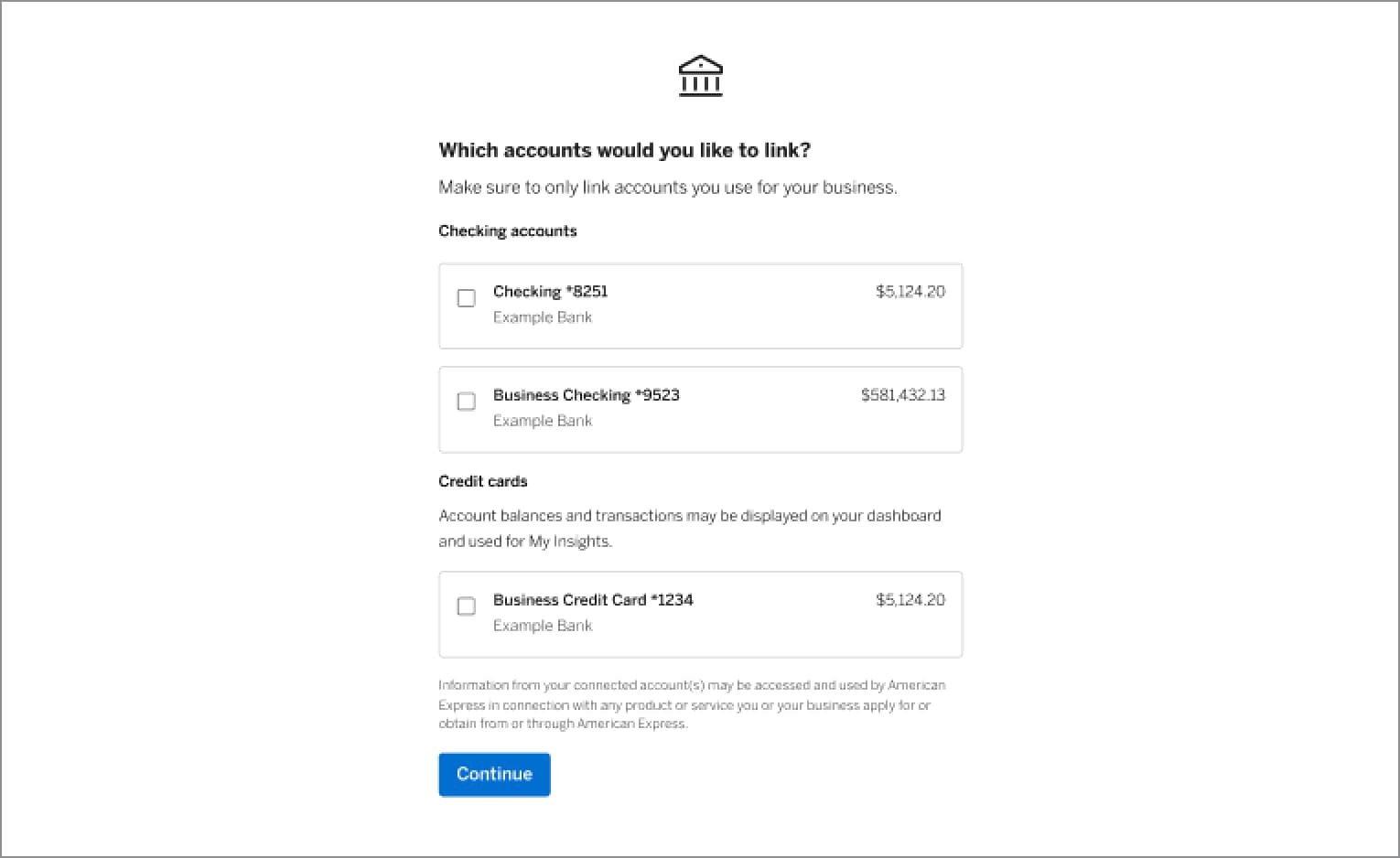

Once you’ve logged in, you have the option of selecting which accounts to link to your dashboard. Select accounts you wish to link and then click “Continue.”

For illustrative purposes only

Step 5: Finish up.

A confirmation screen will let you know that your accounts have successfully been linked.

You will start seeing data from your newly linked account(s) appear on your Business Blueprint dashboard.

You can check the status of each linked account, and reconnect if necessary, on your dashboard.

Step 3: Link your account on file.

If you have already linked eligible accounts to your American Express Business Cards, you will see two options for linking your account. Choose the option titled, “Link bank accounts you’ve already linked to American Express.”

NOTE: If you are taken to a page asking you to choose your bank, it means that you do not have any eligible accounts link. In this case, please go to “Option 1: Link a new account” outlined above.

For illustrative purposes only

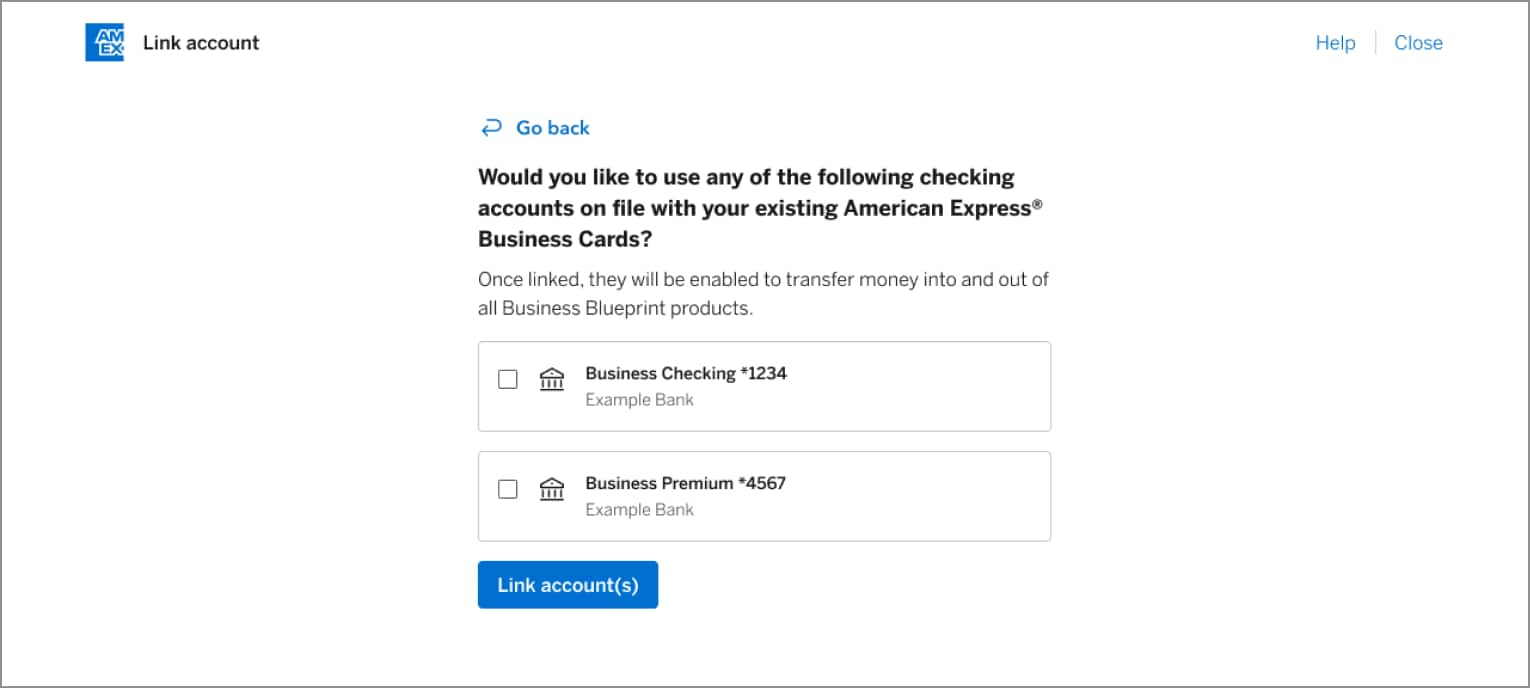

Step 4: Select bank accounts you’d like to link.

On the next screen you will see a list of your eligible accounts. Check the box next to all accounts you wish to link and then click “Link account(s).”

For illustrative purposes only

NOTE: Your selected accounts will now be available for fund transfers. To enable a data connection with your bank, which allows business account balance and transactional data to be integrated into your Business Blueprint platform, visit your "Linked accounts" page and click "Connect" on the respective account.

Step 5: Finish up.

After successfully linking your account, you will be returned to where you started. You will see that the

account is now enabled for transfer.

You can check the status of your linked accounts by visiting the “Linked Accounts” tab of your Business

Blueprint account.

When would I need to verify my linked account?

A linked account must be verified before you can use it to transfer money into and out of accounts related to American Express products. You usually verify an account by providing its routing and account numbers, though micro-deposits may also be used as a method for alternative verification.

How do I unlink a bank account?

In order to remove a previously linked account, you will need to contact us directly.

STILL NEED HELP?

Reach out to us for further guidance.

Deposit accounts offered by American Express National Bank. Member FDIC.

TERMS AND CONDITIONS

American Express Business Blueprint™

American Express Business Blueprint™ is the small businesses digital experience that allows a customer to view on one digital dashboard summary account information for the following American Express small business products: American Express® Business Cards, American Express® Business Line of Credit, and American Express® Business Checking. The customer can also choose to link their third-party issued business bank accounts and business credit cards to Business Blueprint. Not all third-party accounts or cards can be connected to Business Blueprint. Business Blueprint allows the customer to view data insights and track their business cash flow and expenses by viewing reports that American Express prepares using the customer’s linked account information. While the cash flow management service from Business Blueprint is currently free, each of the business products from American Express that are visible in Business Blueprint has its own fees, eligibility criteria, application process and approval requirements. The Business Blueprint service (including any data insights provided to the customer) does not constitute legal, tax, financial or accounting advice, and is not a substitute for obtaining competent personalized advice from a licensed professional. You should seek professional advice before making any decision that could affect the financial health of your business. American Express makes no representations as to the accuracy, completeness or timeliness of the reports, data or account information that are available to the customer from Business Blueprint.™

American Express® Business Line of Credit

American Express® Business Line of Credit offers access to a commercial line of credit ranging from $2,000 to $250,000; however, you may be eligible for a larger line of credit based on our evaluation of your business. Each draw on the line of credit will result in either a separate installment loan or a single repayment loan. All loans are subject to credit approval and are secured by business assets. Every loan requires a personal guarantee. For single repayment loans, we charge a total loan fee that ranges from 0.95%-1.80% of the amount you borrow for 1-month loans, 1.90%-3.75% for 2-month loans, and 2.85%-6.05% for 3-month loans. Single repayment loans incur a loan fee at origination and the principal and total loan fee are due and payable at loan maturity. There are no required monthly repayments for a single repayment loan. Repaying a single repayment loan early will not reduce the loan fee we charge you. For installment loans, we charge a total loan fee that ranges from 3-9% of the amount you borrow for 6-month loans, 6-18% for 12-month loans, 9-27% for 18-month loans, and 12-18% for 24-month loans. Installment loans incur a portion of the total loan fee for each month you have an outstanding balance. If you repay the total of the principal of an installment loan early, you will not be required to pay loan fees that have not posted for subsequent months. For each loan that you take, you will see the applicable loan fee before you take the loan. Once you take the loan, the loan fees that apply to that loan do not change. We reserve the right to change the loan fees that we offer you for new loans at any time. American Express reserves the right to offer promotions to reduce or waive loan fees from time to time. Not all customers will be eligible for the lowest loan fee. Not all loan term lengths are available to all customers. Eligibility is based on creditworthiness and other factors. Not all industries are eligible for American Express® Business Line of Credit. Pricing and line of credit decisions are based on the overall financial profile of you and your business, including history with American Express and other financial institutions, credit history, and other factors. Lines of credit are subject to periodic review and may change or be suspended, accompanied with or without an account closure. Late fees may be assessed. Loans are issued by American Express National Bank.

Single repayment loans may become available to eligible existing and new Business Line of Credit customers at different times.

American Express® Business Checking

We are currently accepting applications from eligible U.S. businesses. Not all applicants will be approved for a Business Checking account. To learn more about Business Checking, including eligibility, visit https://www.americanexpress.com/en-us/business/checking/.

Membership Rewards® Program

Terms and Conditions for the Membership Rewards® program apply. Visit membershiprewards.com/terms for more information. Participating partners and available rewards are subject to change without notice.

The value of Membership Rewards® points varies according to how you choose to use them. To learn more, go to www.membershiprewards.com/pointsinfo

American Express and Amex are registered trademarks of American Express.