Seizing New Business Opportunities Through Hong Kong-ASEAN Free Trade Agreement

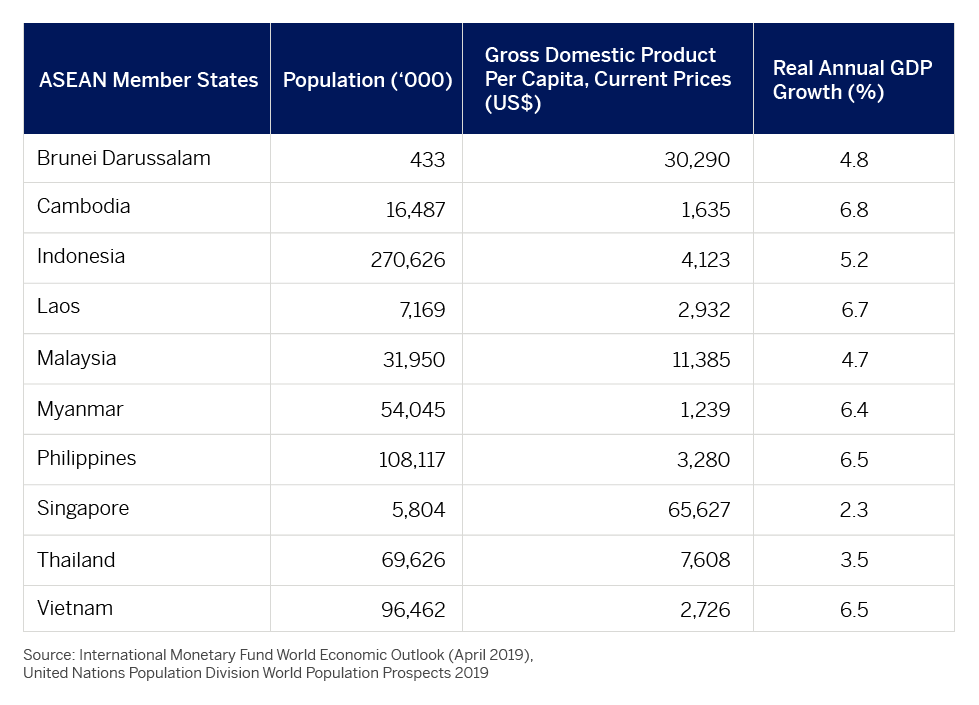

The Trade and Industry Department (TID) of the Hong Kong Government announced in June that the free trade agreement (FTA) between Hong Kong and ASEAN (Association of Southeast Nations) has come into force for five ASEAN countries namely Laos, Myanmar, Singapore, Thailand and Vietnam. For the remaining member states, which are Brunei, Cambodia, Indonesia, Malaysia and the Philippines, the FTA will come into force as soon as the dates are confirmed.

This FTA is a significant development for Hong Kong businesses trading with ASEAN countries. According to the TID, ASEAN was Hong Kong's second largest trading partner in merchandise trade in 2018 and the fourth largest in services trade in 2017. Total merchandise trade between Hong Kong and ASEAN amounted to HK$1,070 billion in 2018 and total services trade between the two sides was HK$127 billion in 2017. With the FTA in force, the government expects that there will be greater legal certainty, better market access and fair and equitable treatment in trade and investment, thereby creating new business opportunities for Hong Kong businesses.

Key features

As part of the agreement, ASEAN Member States (AMS) have agreed to progressively eliminate or reduce their customs duties on goods originating from Hong Kong. For example, Singapore commits to binding all its customs duties at zero while Thailand will eliminate customs duties of about 85 per cent of their tariff lines within 10 years and reduce customs duties of about another 10 per cent of their tariff lines within 14 years. Other AMS have also similar commitments at varying levels and timeframes. The tariff reduction commitments cover different kinds of Hong Kong commodities, including jewelry, articles of apparel and clothing accessories, watches and clocks, toys, etc.

Hong Kong businesses involved in the provision of services will also benefit. Through the FTA, they can expect the removal or reductions of various restrictions such as types of legal entity, foreign capital participation, number of service providers or operations, value of service transactions, and number of persons employed, etc. For example, Thailand and Viet Nam allow Hong Kong enterprises to have foreign capital participation of up to 50 per cent or even full ownership in many sectors.

AMS will also make it easier to enter their borders to conduct business. There will be arrangements to facilitate temporary or longer term stays for business visitors, intra-corporate transferees, specialists/experts/professionals and contractual services suppliers.

TID has highlighted that some of the sectors liberalized for Hong Kong by the AMS include commitments that exceed those made under the multilateral agreement of the World Trade Organization. For example, Thailand will open arbitration services and electronic mail services; Singapore will open technical testing and analysis services and adult education services; Laos will open specialty design services, retailing services, and certain services of trading for own account or for account of customers under financial services; and Myanmar will open a significant number and wide range of services sectors

Tackling the ASEAN consumer

According to research by the Hong Kong Trade Development Council (HKTDC), ASEAN is a huge consumer market with growing income and expenditure. With a combined population of more than 660 million, ASEAN is the world’s third most populous market after China and India. It also has a young workforce with some 60% of its population under the age of 35. HKTDC believes that the young demographics and positive economic trends will set average ASEAN disposable income and consumer expenditure towards growth in the coming years.

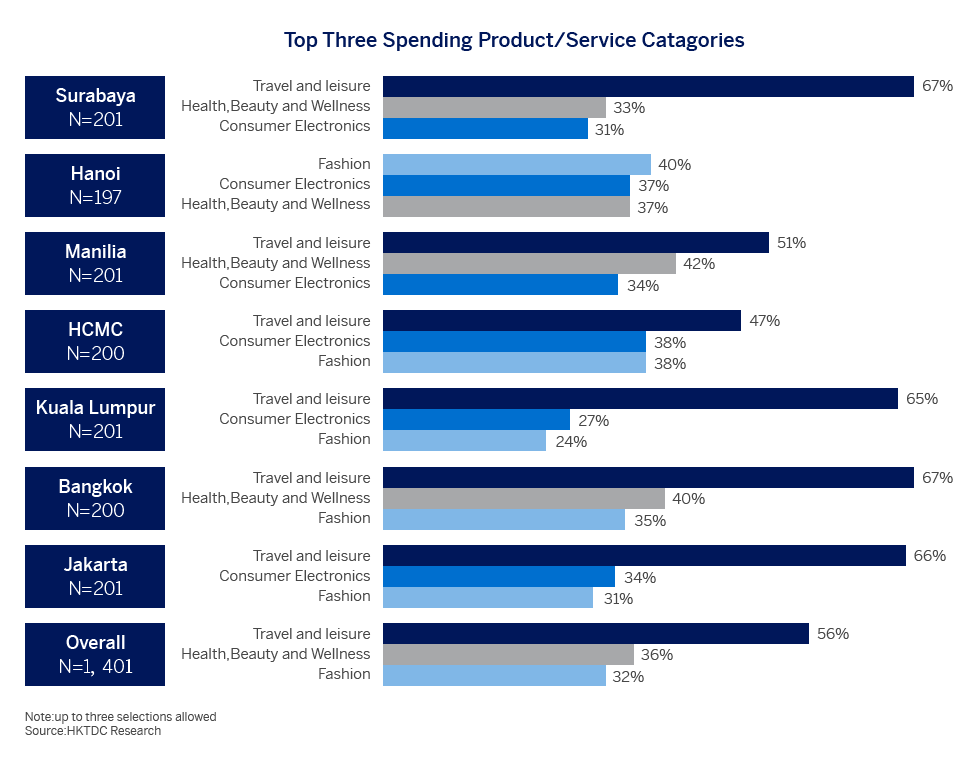

So what are the tastes and spending preferences of ASEAN consumers? Despite the diversity of the markets, HKTDC found some commonalities in a 2017 survey it conducted of middle-income consumers from across 7 large ASEAN cities, namely Bangkok, Kuala Lumpur, Manila, Jakarta, Surabaya, Ho Chi Minh City, and Hanoi.

Notably, the top categories of expenditure of ASEAN consumers went to: “Travel and Leisure”, “Health, Beauty and Wellness” and “Consumer Electronics”, reflecting the desire of the consumers to upgrade their lifestyle and enjoy better quality products as their incomes rise.

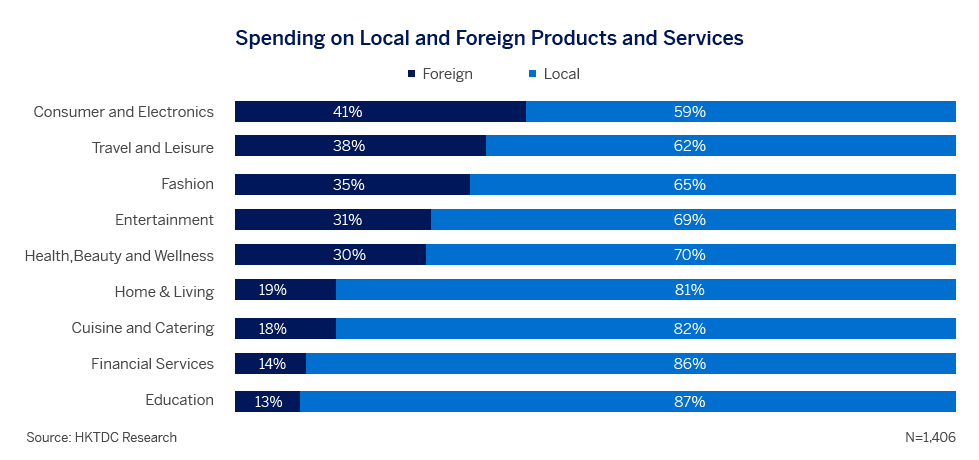

There is likely still a lot of room for Hong Kong businesses looking to penetrate ASEAN markets. HKTDC’s survey shows that while local brands still dominate domestic markets, many of the middle-class consumers may be looking to try foreign brands as their incomes continue to rise. In fact 68% of respondents indicated that they prefer imported or international brands to locally produced or domestic brands.

How American Express can help Hong Kong enterprises conquer the ASEAN market

These are exciting times for companies embarking on the ASEAN journey. To maximize the chance of success, they will have to overcome various hurdles be it cultural, regulatory, logistics or financial. For years, American Express (Amex) has built its reputation on helping companies of all sizes with the payment tools and flexibility they need as they seek to internationalize their businesses. With its offerings such as corporate and purchasing cards, business travel accounts and centralized billing solutions, Amex helps reduce the pain points in business operations and allow businesses to focus on their international expansion strategies.

Additional Resources

Post-covid Business Recovery: Strategies to Help SMEs Adapt to The New Reality

Amid changing lifestyles and business practices and with so many different forces in play, here are several suggestions on how SMEs...

Hong Kong finance executives anticipate strong economic growth

Hong Kong finance executives anticipate strong economic growth

Hong Kong’s top…

Apply Now

Turn every business expenses into rewards. Enjoy welcome offer up to HK$2,800 and first year annual fee waiver!