There are many ways to assess the success of a business, but the king of them all is net income.

“Net income is a true representation of how profitable you are,” says Max Dubiel, Founder of Redemption Roasters, a coffee chain whose mission is to give work opportunities to former prisoners. “It is the income of a company after expenses. It is the one metric that matters for aspiring and growing businesses.”

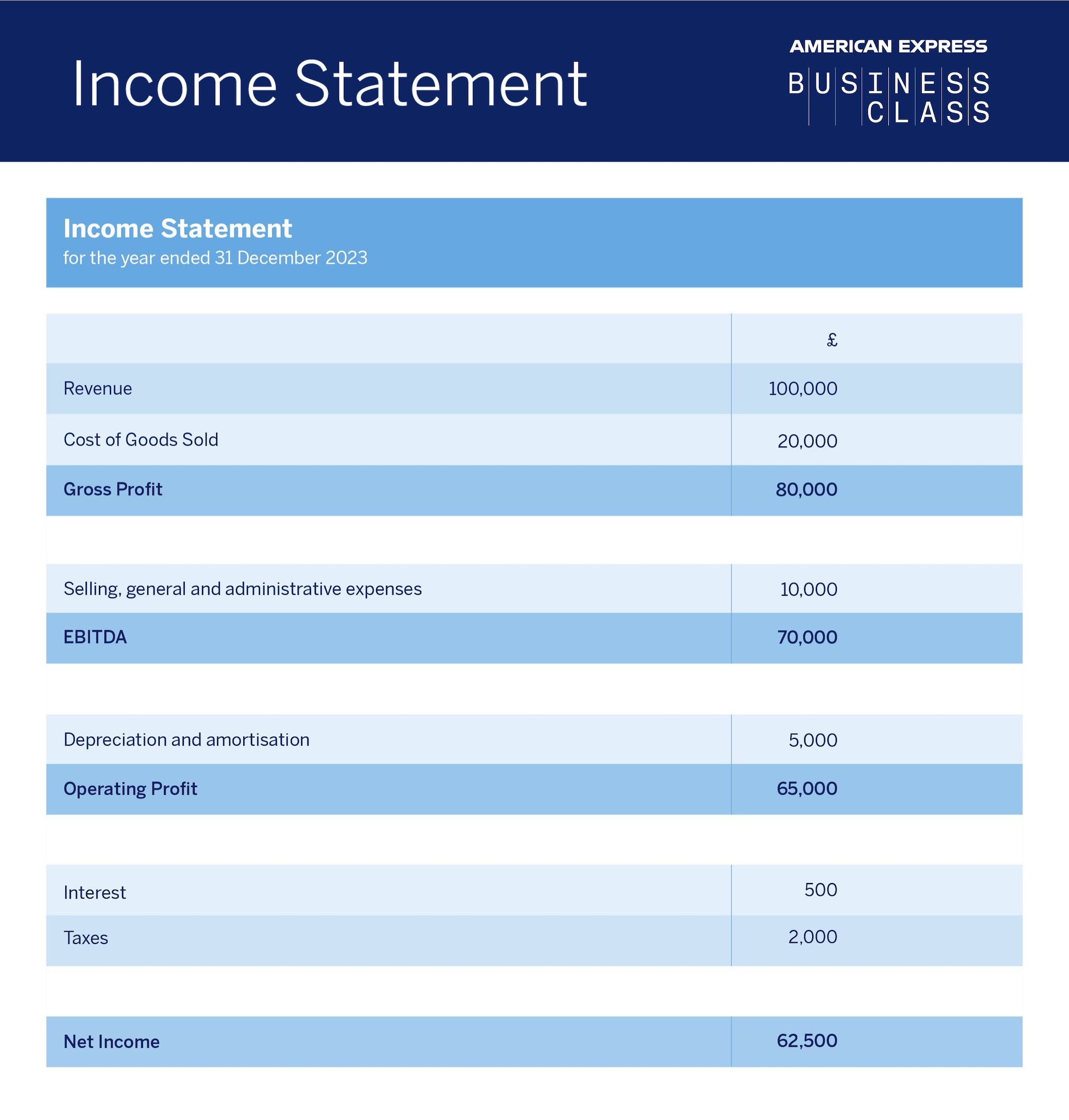

“There are other useful metrics,” adds Dubiel. “Venture capitalists look at EBITDA, which is earnings before interest, tax, depreciation and amortisation. They believe it makes it easier to compare like-for-like, as interest rates or tax may vary year-on-year, so they want to see profit before those factors are taken into account. But if you own a company, you want to know how much money you've made at the end of the year, after tax and interest. That's net income.”

Why is net income called the bottom line?

Net income is commonly referred to as the bottom line because it sits at the bottom of the income statement. This statement, also known as the profit and loss statement (P&L) calculates your business's profits over the past year. Typically, an income statement will start with revenue at the top and then deduct items in sequence, with net income as the bottom line. This can be seen clearly on the sample income statement below:

Other names for net income

The layman's term for net income is simply profit. It is what a business keeps after interest, tax, and other accounting measures such as depreciation and amortisation.

But net income may also be referred to as net profit, net earnings, profit after tax, net income available to shareholders or, as discussed, the bottom line.

Why understanding net income is important

Understanding the composition of net income is vital to managers, shareholders, and accountants.

“There is no way of fudging net income,” says Ellis Bennett, Founder of EA Accountancy, an accountancy practice with over 300 clients. “People on social media talk about gross revenue and gross profit. There's only one that matters, and that's net income; the money you have left after everything is accounted for.”

Small business owners may choose to take out net income as dividends at the end of the financial year or keep the money in the business to invest and expand. Without a positive net income, the company is breaking even or recording a loss.

Calculate net income for your business

To calculate net income, subtract total expenses from total revenue:

Net Income = Total Revenue - Total Expenses

Each of these items should be included when calculating your total expenses:

Cost of goods sold (COGS): COGS represents the direct costs associated with producing goods or services sold by a company. It includes expenses such as raw materials, labour costs directly related to production, and manufacturing overheads.

Operating expenses: These expenses are incurred in the day-to-day operations of a business and are not directly tied to the production of goods or services. They include:

- Wages: Payments made to employees for their services, including salaries, wages, bonuses, and commissions.

- Rent: The cost of leasing or renting space for business operations, such as office space, retail stores, or manufacturing facilities.

- Utilities: Expenses related to essential services like electricity, water, heating, and internet connection used in the business.

- Insurance: Premiums paid to insure business assets, property, liability, and employee health.

- Marketing: Expenditures on promoting the business, including advertising campaigns, marketing materials, and sponsorships.

- Depreciation: The allocation of the cost of assets over their useful lives, representing the wear and tear or obsolescence of tangible assets like machinery, equipment, and buildings.

- Maintenance: Costs associated with repairing and maintaining equipment, vehicles, facilities, and other assets.

- Professional services: Fees paid to external professionals such as lawyers, accountants, consultants, and advisors.

- Travel and entertainment: Expenses related to business travel, accommodation, meals, and entertainment for clients or employees.

Interest expenses: These are costs incurred from borrowing funds or financing activities. They include interest payments on loans, lines of credit, bonds, and other forms of debt.

Taxes: Businesses are subject to various taxes, including income taxes, property taxes, sales taxes, and payroll taxes.

Non-operating expenses: These are expenses not directly related to the core business operations. They may include losses from the sale of assets, impairment charges, or legal settlements.

Extraordinary expenses: Unusual or infrequent expenses that are not expected to occur regularly. Examples include natural disaster losses, restructuring costs, or write-offs.

Juggling the payment of business expenses with revenue coming into the business is a major pressure on many small business owners. With an American Express® Business Gold Card, you get up to 54 days to clear your Card balance, which may help put more flexibility in your cash flow¹.

Gross income v net income

A comparator to net income is gross income. It is the profit a company retains after subtracting the direct costs of production, such as raw materials, shipping costs, labour, and marketing. Indirect costs, such as administration or legal bills, are not deducted. Nor are taxes. Gross income states the profitability of a company without considering financial factors or non-core expenses.

Net income in other financial statements

The metrics of net income form part of a larger picture. Business managers will need to understand these financial statements:

- Balance sheet

- Income statement (also known as profit and loss statement)

- Cash flow statement

- Statement of retained earnings

In each case, net income remains the same. On the balance sheet, it appears as an asset, to be set against liabilities.

A cash flow statement explores how a cash balance flows from one period to the next - this could be over a year, but can also be broken down into month-by-month or week-by-week assessments. It is a particularly helpful statement for small businesses with limited resources to understand how much cash they have coming in or going out at any point in time.

The statement of retained earnings will show how much net income is held by a company, rather than distributed to shareholders.

In the end, net income takes primacy over all other accounting metrics. It reveals in a single figure, after all costs and taxes are accounted for, how much profit a company made in a year.

1. The maximum payment period on purchases is 54 calendar days and is obtained only if you spend on the first day of the new statement period and repay the balance in full on the due date. If you'd prefer a Card with no annual fee, rewards or other features, an alternative option is available – the Business Basic Card.