Deferred income refers to money that your company receives for goods or services that haven’t been delivered to your customer. This might be because goods are in high demand, because you or your supplier needs a deposit to pay for materials, or because the service is provided on a subscription model.

If your business uses this type of unearned income in its accounts, then it is important to understand and account for it accurately¹.

Summary

- Should a business defer income?

- Examples of deferred income

- Deferred income on the balance sheet

- Deferred income as a liability

- Pros and cons of deferred income

- Which types of businesses defer income?

Should a business defer income?

Deferring income may be important for certain business types where the company needs to capture income before it is earned.

For example, if you run a graphic design company, you might charge customers a percentage of the contract upfront to guarantee a commitment from them, or to secure freelance contractors to deliver the job. Some companies need to charge upfront to deliver products, such as ingredients for a wedding cake company.

Subscriptions are generally paid in advance, where the customer might pay for 12-month access to a service at the start of the agreement.

This 'unearned' income allows the company to record the value of this payment while recognising that if the product or service is not delivered, then the customer will be reimbursed. In this respect, deferred income is a liability rather than earned revenue.

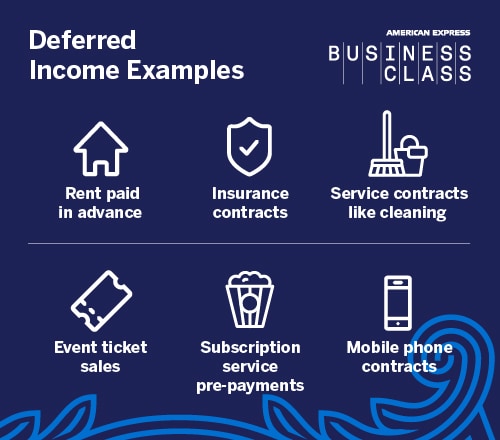

Examples of deferred income

Some common examples of deferred income include creative services such as software development where the customer makes an upfront payment to secure services before the professional work starts.

|

Deferred income is observed in subscription-based ventures like TV streaming or newspaper services, where a periodic fee is paid by the customer for consistent access to a service or publication. “This type of revenue model can be particularly effective for assets that can be continually delivered or accessed over time,” says Emanuele Visintin, Operational Director of Direct Payroll Services.

Swoperz is an online marketplace for pre-loved children’s clothes that works on a subscription pricing model, which provides the business with a predictable monthly income. “We have this base income and that means we have reliability and can do better forecasting, and make investments in new features like gamification features or the ability to buy additional tokens to use on the site,” says Charlene Thurlock, the company’s Co-Founder.

Deferred income on the balance sheet

Since your business hasn’t yet delivered the goods involved in deferred income, it can’t be listed in your sales accounts. Instead, deferred income is listed as a liability on the company balance sheet, since the business owes the customer that money until the product or service has been delivered.

Deferred income should be listed as a current liability on the balance sheet under payables, and once the goods are delivered to the customer the liability can be removed, and the income listed under sales.

Why is deferred income treated as a liability?

Although the customer has paid money to the business, deferred income should always be treated as a liability. This is because the business has an obligation to deliver to the customer.

For example, a software company charges £100 to deliver a new website. Until that website is delivered, the money has not been earned. So, the income is owed to the customer if the website never gets built and delivered.

In the case of Swoperz, a monthly subscription payment costs £15, but there is a discount for customers who pay for an annual subscription upfront. This revenue is recorded as a liability, and each month a deferred income payment of £15 is credited against the liability until the end of the year when the company’s obligation to the customer is fulfilled.

It's important to be aware of the dangers of treating deferred income as current income. In the event that your company does not deliver the service provided and needs to refund the customer, you could find yourself running out of cash. Assuming deferred income is liquid cash can also give a misleading view of your company's cash flow position.

Using an American Express® Business Gold Card can help you to invest in business essentials at the right time, even while you are waiting for deferred income to be available as cash flow. With payment terms of up to 54 days, businesses can invest in essentials like IT equipment or raw materials at the right time².

Advantages and disadvantages of deferred income

While weighing up the pros and cons of deferred income, there are arguments on both sides, says Hurlock. “For us, the pros are about delivering a better value product to customers, and having predictability in cash flow, which supports better forecasting,” she says. “But there are downsides because our accounts don’t necessarily show that income right away, which has a knock-on effect on our ability to raise funds based on our revenue.”

Advantages of deferred income

According to some, deferred income may help companies manage their cash flow to deliver certain products or services. For example, a software company might use advance payments to invest in product contractors, whereas a streaming company like Netflix relies on subscription payments to fund the creation and delivery of new content.

“A key benefit of subscriptions is that you can have reliable monthly recurring revenue, which can improve cash flow and liquidity for your business,” says Visintin. “The convenience of subscription models can also decrease customer acquisition costs and can attract new customers.”

Disadvantages of deferred income

As a business liability, deferred income carries a degree of risk. If a business uses deferred income to fund large capital investments and customers cancel their orders, the business could face serious cash flow challenges.

Tracking deferred income can be complex, especially once a company is tracking income from many customers with different periods over which revenue can be recognised as earned income.

It is therefore important to monitor deferred income and expenses closely to ensure that you are not using deferred income in a way that could compromise your company’s ability to meet ongoing expenses and meet outstanding customer obligations.

Which types of businesses defer income?

Most companies that sell products or services requiring pre-payments or retainer invoices will defer income, along with businesses using a subscription model. This can include:

- Advance rent for properties and premises

- Mobile service contracts

- Ticket sales

- Prepayment for subscription services

- Annual subscription to online services, e.g. streaming or software

1. The information provided in this article is for informational purposes only and does not constitute financial advice. Always consult a qualified professional before making financial decisions. We are not liable for any actions taken based on this information.

2. The maximum payment period on purchases is 54 calendar days and is obtained only if you spend on the first day of the new statement period and repay the balance in full on the due date. If you'd prefer a Card with no annual fee, rewards or other features, an alternative option is available – the Business Basic Card.