The UK Government has taken measures to minimise Brexit business disruption, but new requirements for customs and contracts have left businesses that rely on import and export with significantly more documentation to manage. To ensure the continued smooth running of your business, it’s crucial that business owners work proactively to stay a step ahead of the game.

This article will cover some of the practical points that businesses should be aware of to successfully manage import and export post-Brexit.

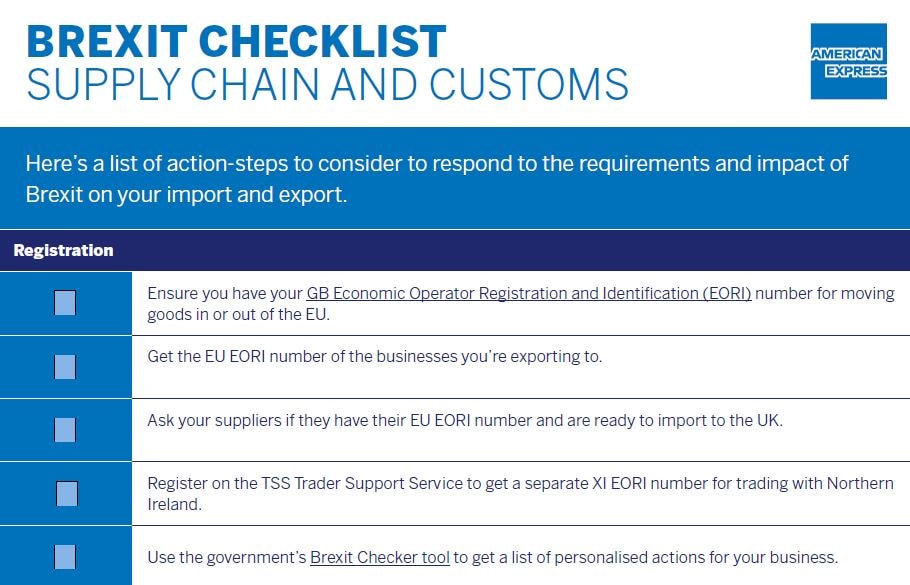

And, in order to help you efficiently plan for the future, we have created a checklist with all the to-do items you need to keep your supply chain running smoothly in the post-Brexit transition period. Download it here.

Click on the image to enlarge and download an editable PDF template

Managing your customs

If you choose to train your personnel to handle the new customs declarations requirements, consider hiring a customers brokerage that can offer training and guidance on the extra paperwork. You will need to be registered for the Custom Handling of Import and Export Freight (CHIEF) system and have software compatible with CHIEF.

Simon Hyde, CEO of FAUN-Zoeller, the UK arm of a German-owned waste management company, says he handled all customs and Brexit-related changes internally, using a steering committee that clearly communicated the impact of Brexit across each service, function and operation of the business. “They delivered a series of Brexit ‘breakfast’ sessions for staff to be informed and we also welcomed employee feedback,” says Hyde.

Jerome Brustlein, Chief Operating Officer of Fenton, a jewellery brand, says they decided against hiring a customs broker to handle the additional documentation and instead relied on support from their shipping partners to help navigate the situation. Fenton is also training its operation team regularly to ensure they’re up to date with the latest HRMC and courier regulations.

Hiring a customs broker

Hyde says that while his team was able to manage the majority of the extra documentation internally, “it was more cost-effective to outsource the actual customs submission to an agent.” There is a long list of government-approved agents to choose from, Hyde advises to “look at their software, get a demonstration and see what support they offer as you will inevitably have some interruption as you learn by doing.”

When selecting a broker to work with, look out for customs agents with experience in working with your product type and trained staff that know how to manage the new customs procedures. You can also ask your EU supplier for a customs broker recommendation, as they may already be using an agent for the export declaration who will know how to handle the UK import declaration.

However, the Road Haulage Association (RHA) has warned that the customs brokerage industry is overwhelmed with demand, so businesses may face higher-than-usual brokerage costs.

Goods classification and documentation

The good news is that the UK will continue to use the same code system as is used throughout the EU. You can use the Government’s free tool to look up which codes apply to the goods you want to import - you will need commodity codes on all goods import declarations.

The Government’s online checker tool helps show you which tax and duty rates, exporting documents, and certificates or licenses you may need for each good on your export list. The invoice with the price you’re selling the goods for and any required licenses or certificates must travel along with the goods.

Import VAT

Businesses will need to make changes in how they complete their VAT import return - the UK is no longer in the EU customs and VAT systems; VAT reporting will change to imports and exports instead of dispatches and acquisitions. VAT will now also be payable on import, however, the UK Government has introduced the postponed VAT payment system, so you can account for VAT on your VAT return.

In practice, nothing will change for your cash flow, but you must include your VAT registration number on your customs declaration. “I would recommend companies apply for a duty deferment account,” says Hyde, “as this will still be useful for imports from non-EU countries and the Government has set up a new scheme to allow traders to apply with a limit up to £10,000 without the need for a bank guarantee.” You can also choose to pay VAT at the tax point - to do this, you’ll need monthly C79 reports from HMRC.

Export VAT

Thanks to the no-tariff trade deal, for exported goods, there is a zero-rating VAT. This means that although there is no payable export VAT, you will have to include the zero-rating VAT for exports in your accounting. Check with your accountants about any needed updates to your invoicing software to ensure your post-Brexit VAT accounting reflects this change.

“All of our products no longer include UK VAT when we sell outside of the EU and we have updated our financial systems accordingly,” says Brustlein. “We have also had to make these changes in our e-commerce platform, Shopify, to reflect the updated VAT regulations. We are now looking into setting up a European entity to make it more efficient for our business to import from our workshops in India and Thailand.”

Having to manage lots of extra paperwork on your import and export may seem daunting, but tackling the Brexit challenge head-on and getting your ducks in a row for a smooth border crossing will pay off big dividends - for your peace of mind as well as for your business. “We adapted our supply chain and will focus on what we can do - not what we can’t do,” says Hyde. “We are encouraging our customers to hit the 'RESET’ button, as we have.”

Download our Brexit supply chain and customs checklist here to ensure your business is compliant with the latest regulations.