Empower Your Business with Flexible Payment Option

When you’re with American Express, you have access to Flexible Payment Option

– a seamless way to manage your expenses on your terms.

Choose a payment path

for your business

With the ease, flexibility, and control of Flexible Payment Option, you get the freedom to pay off your balance over time, on your terms, while still enjoying the same benefits and features of your Card with No Pre-set Spending Limit.1 Tailor payment schedules to best suit your business needs.

Ease

As an embedded feature on select Cards, the Flexible Payment Option is always available and instantly accessible. Avoid the effort and uncertainty of applying for a loan and be prepared in case of unexpected expenses or opportunities.

Flexibility

Decide how much you prefer to pay and how quickly your balance is paid off. This gives you flexibility to pay the way that’s most convenient to you and adjust payments to suit your circumstances. Pay your full balance, minimum amount due, or any amount in between2.

Control

You’re in the driver’s seat. Eligible charges will be added to your Flexible Payment Option balance so you can control if and when you carry a balance on your card.

Unexpected Expenses

Use Flexible Payment Option to help in times of your business’ cash flow squeeze.

Business Opportunities

Make sure you don’t miss out on any exciting business opportunities – without disrupting your monthly budget.

Unexpected Expenses

Use Flexible Payment Option to help in times of your business’ cash flow squeeze.

Business Opportunities

Make sure you don’t miss out on any exciting business opportunities – without disrupting your monthly budget.

How Flexible Payment

Option works

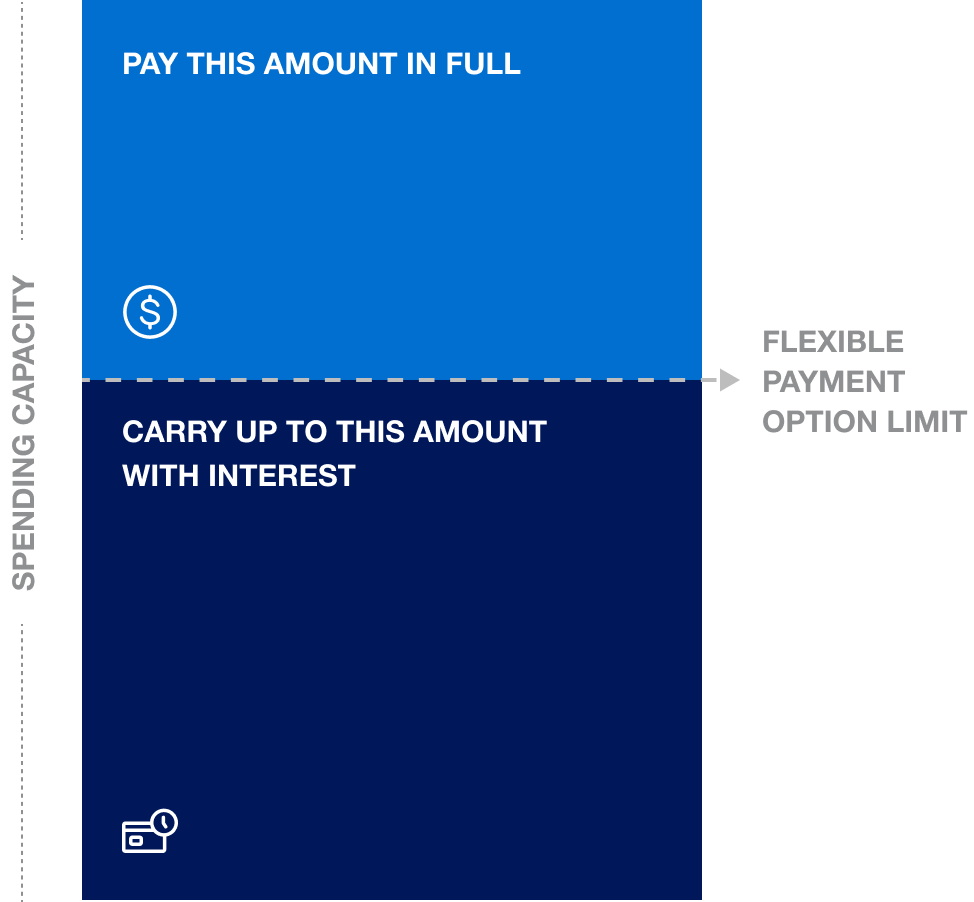

While it allows you to make payments on your terms, there are things to note when it comes to spending capacity and purchases you’re able to cover using Flexible Payment Option.

With Flexible Payment Option, you have No Pre-set Spending Limit.1 This is a unique feature that gives you flexible spending capacity. The amount you can spend adapts based on your purchase, payment, and credit history. If you’re unsure a large purchase will be approved, use the Check Spending Power tool in your online account or Amex App.

While your Card has No Pre-set Spending Limit, there is a limit to the total amount you can pay over time – your Flexible Payment Option Limit*. When you reach your limit, any amount over will be due in full by your new payment due date.

*To view your Flexible Payment Option Limit, log into your online account or the Amex App and click “Balance

Details” on the right of the screen. This is the total amount you can choose to repay over time.

Questions? We’ve got answers!

Customers who signed up prior to July 21st, 2021 OR after March 18th 2022 – You are already enrolled in Flexible Payment Option and all purchases are FPO eligible.

Customers who signed up between July 22nd, 2021 and March 17th, 2022 – You will be receiving more information soon about when Flexible Payment Option will be available to you.

Flexible Payment Option allows you to pay your account balance in full, the Minimum Amount Due, or any amount in between.

There’s nothing you need to do to enroll or activate this new feature, simply continue to make purchases as usual. All purchases up to your Flexible Payment Option Limit will be eligible for the Flexible Payment Option; any purchase amount over your Flexible Payment Option Limit will be due in full.

When you receive your monthly statement, you can pay the New Balance on your statement in full, the Minimum Amount Due, or any amount in between. If you choose to pay your total New Balance each month on time, you won’t be charged interest on purchases.

Your Flexible Payment Option Limit is the maximum amount on your account that you can repay over time. If your Outstanding Balance exceeds this limit, the excess amount must be paid in full by your next Payment Due Date. This limit is subject to your No Pre-set Spending Limit. You can find your Flexible Payment Option Limit on your statement, online account or mobile app.

Unlike traditional credit cards that have set spending limits, your account has No Pre-set Spending Limit which adjusts based on factors such as your purchases, payment, and credit history. Your Flexible Payment Option Limit is not a spending limit, rather, it is the maximum amount you can repay over time with interest.

If you are ever unsure if a large purchase will be approved, just use the ‘Check Spending Power’ tool on your online account or mobile app.

If you are currently enrolled in Pre-Authorized Payment, your payment amount will remain set to total New Balance.

If you wish to take advantage of Flexible Payment Option, you can visit your Pre-Authorized Payment Plan Settings page on your online account to change your automatic payment setting.

If you do not wish to take advantage of the Flexible Payment Option, you can simply pay the total New Balance indicated on your statement each month.

- As a charge Card, there is No Pre-set Spending Limit. No Pre-Set Spending Limit on purchases does not mean unlimited spending. Your purchases are approved based on a variety of factors, including your credit history, account history, and personal resources. Proof of resources and security may be required.

- This charge Card has both Due in Full and Flexible Payment Option balances. All Due in Full balances must be paid each month. Interest rate of 30% applies to each delinquent Due in Full charge. This rate is effective from the day account is opened. The Preferred rate of 21.99% applies to your Flexible Payment Option balance. If you have 2 separate Missed Payments in a 12 month period, the Flexible Payment Option rate for your account will be 25.99%. If you have 3 or more separate Missed Payments in a 12 month period, the Flexible Payment Option rate will be 29.99%. These rates are effective from the day the Flexible Payment Option is first available on your account. If you are an existing Cardmember, please refer to your statement for more details on Annual Interest rates for Flexible payment option & Due in full balances.