English | Français

Marriott Bonvoy® Business American Express®* Card

Transform how you do business

with the Marriott Bonvoy® Business American Express®* Card

Welcome Bonus

Earn 60,000 Welcome Bonus points

New Marriott Bonvoy® Business American Express®* Cardmembers, earn 60,000 Welcome Bonus

points after you spend $5,000 on your Card in your first 3 months of Cardmembership.2

Offer subject to change at any time.

Earn Marriott Bonvoy points on every purchase

5: $1

Earn 5 points for every $1 in eligible Card purchases1 at participating Marriott Bonvoy hotels1.

3: $1

Earn 3 points for every $1 in card purchases on eligible gas, dining and travel1.

2: $1

Earn 2 points for every $1 in all other Card purchases1.

That's on top of the points you already earn with your Marriott Bonvoy membership.

Key Benefits

Receive an Annual Free Night Award3 after your anniversary each year.

Automatic Marriott Bonvoy Silver Elite status membership.

Receive 15 Elite Night Credits each calendar year with your Marriott Bonvoy® Business American Express®* Card. These can be used towards attaining the next level of Elite status in the Marriott Bonvoy program16.

Upgrade to Gold Elite status after you charge $30,000 in net purchases to your Card each year, or when you combine 10 qualifying paid nights within one calendar year with the 15 Elite Night Credits from your card.4

Marriott Bonvoy Members who have Gold Elite status receive brag-worthy benefits4 like:

Room Upgrade

A room upgrade at check-in – corner room, higher floor, or better view – when available.

Late Checkout

2 pm. late checkout, subject to availability at resort and conference center hotels, so you can enjoy your stay for even longer.

Annual Fee

$150

(annual interest rate 21.99% on purchases and 21.99% funds advances)*

Additional Cards

$50 Annual Fee for each Additional Card5

Additional Cards are very useful tool to help you control employee expenses plus track and accumulate points on your Marriott Bonvoy account, so you have an opportunity to maximize the points you earn.

Marriott Bonvoy Member Benefits

Free Night’s Stay

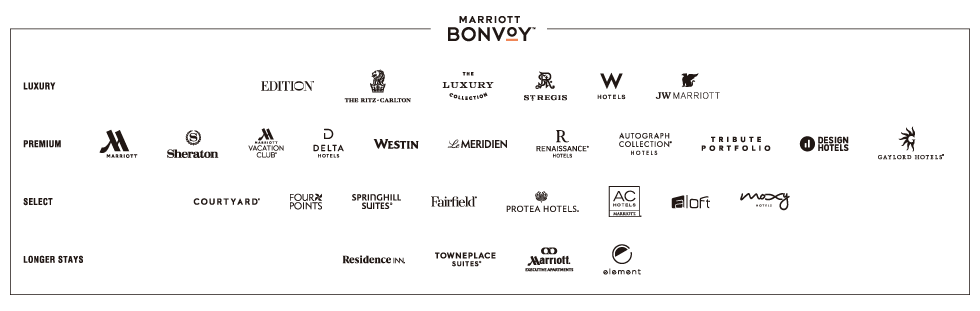

Redeem points for free nights with no blackout dates at over 7,000 of the world’s most extraordinary hotels7. Experience distinct brands like The Ritz-Carlton™, St. Regis™, W Hotels™, Le Méridien™, Westin™, Aloft™, and more.

Transfer Points

Transfer points to frequent flyer miles with a wide selection of airlines, and receive a bonus from Marriott of 5,000* miles for every 60,000 points you transfer.8,9

*The offer of 5,000 bonus miles does not apply to American Airlines AAdvantage, Avianca LifeMiles, Delta SkyMiles and Korean Air SKYPASS. Other conditions apply.

Upgrade your Travel Experience

Use your points to book cruises through Marriott’s Cruise

With Points programs, flights, car rentals and more. Conditions apply.

Shopping

Redeem your points for the latest tech, fashion trends, gift cards and more. Conditions apply.

Business Tools

✓ Access business savings and expense management tools like our Business Savings Program9 and Online Expense Management Reports

✓ Dedicated business servicing representatives

✓ Business Coverage:

- Employee Card Misuse Protection10

✓ Cash Flow Payment Flexibility:

- Leverage your cash flow with the option of carrying a balance or paying in full each month

Amex ExperiencesTM, Travel, and Shopping Related Benefits

Amex ExperiencesTM

Get access to Front Of The Line® Amex Presale Tickets™ and Amex Reserved Tickets™ to some of the most in-demand concerts, theatre productions, and special events often before the general public.11

Travel Insurance

Travel Insurances such as Flight Delay Insurance12†, Car Rental Theft and Damage Insurance13† and more.

Shopping Coverage

Shopping Coverage including Buyer’s Assurance® Protection Plan14† and Purchase Protection® Plan15†.

Payment Flexibility with Plan It®

Split large balances into manageable monthly payments with no additional interest and a fixed monthly fee with Plan It.17 Learn more about this payment option at amex.ca/installments

Marriott Bonvoy®

Business American Express®* Card

Earn 60,000 Welcome Bonus Points2

Offer subject to change at any time.

Is this Card for personal use?

Take advantage of the Marriott Bonvoy® American Express®* Card.

* Subject to approval. The preferred rate for purchases is 21.99% and funds advances is 21.99%. If you have Missed Payments, the applicable rates for your account will be 25.99% and/or 29.99%. See the information box included with the application for the definition of Missed Payment and which rates apply to charges on your account and other details.

1. Account must be in good standing. You will earn five (5) Marriott Bonvoy points from American Express for every $1 of eligible purchases (less credits and returns) charged on your Marriott Bonvoy Business American Express Card when charged directly with participating Marriott Bonvoy properties, standalone Marriott Bonvoy retail establishments, and Marriott Bonvoy online stores (including online purchases of Marriott Bonvoy gift cards), that in each case, are owned or managed by Marriott International, Inc. and its affiliates. You can earn three (3) points for every $1 in eligible purchases charged on your Marriott Bonvoy Business American Express Card at American Express retail merchants as follows: (i) at stand-alone automobile gasoline stations in Canada; (ii) restaurants, quick service restaurants, coffee shops and drinking establishments in Canada; and (iii) for travel services or travel bookings including air, water, rail and road transport, but not including local and commuter transportation. Purchases at merchants where travel sales are not their primary business (including general merchandise retailers) do not qualify for the earn rate in this category. Merchants are typically assigned codes and categorized based on what they sell. Earn rate of two (2) points for every $1 applies when the merchant code is not in an eligible category, using a payment account or service of a third party, a card reader attached to a mobile phone or online retailer that sells goods of other merchants or the merchant category is otherwise not identified. Points will be earned on the amount of all eligible purchases, less credits and returns. Funds advances, interest, balance transfers, Amex cheques, annual fees (if applicable), other fees, and charges for travelers cheques and foreign currencies are not purchases and do not qualify for points.

2. This offer is only available to new Marriott Bonvoy® Business American Express®* Cardmembers (‘Cardmembers’). For current or former Marriott Bonvoy Business American Express Cardmembers, we may approve your application, but you will not be eligible for the welcome bonus. To qualify for the 60,000 Bonus points, you must have at least $5,000 in net purchases posted to your account on or before your three (3) month anniversary date. Funds advances, interest, balance transfers, Amex cheques, annual fees (if applicable), other fees, and charges for travelers cheques and foreign currencies are not purchases and do not qualify for eligible purchases. Please allow up to 8 weeks after earning your points for your account to be updated. Offer subject to change at any time.

3. Each year, 8-10 weeks after your annual reset date, you will earn an Annual Free Night Award redeemable within 1 year from issuing for an available single or double occupancy standard room at participating Marriott Bonvoy properties with a room rate of up to 35,000 points, inclusive of room rate and applicable taxes but exclusive of resort fee. Account must be in good standing. To view the full terms and conditions, visit www.marriottbonvoy.com/terms.

4. Each year if, before the annual reset date based on your Card anniversary, you reach $30,000 in net purchases charged to your account, or after you stay 10 qualifying paid nights within one calendar year and combine these nights with 15 Elite Night Credits from your Card, you will earn Marriott Bonvoy Gold Elite status in the Marriott Bonvoy program for a minimum of 1 year (unless you are already enrolled at that or a higher level). Account must be in good standing. On the annual reset date, the amount of annual net purchases resets to zero. Gold and Silver Elite Benefits are subject to the terms and conditions of the Marriott Bonvoy program available at marriottbonvoy.com/terms. If you already have Gold Elite status or higher status in the Marriott Bonvoy program, you will retain that status as long as you meet the requirements specified in the Marriott Bonvoy terms and conditions.

5. Account must be in good standing. Maximum of 99 Supplementary Cards per account. Supplementary Card applicant must be the age of majority. Supplementary Cards have an annual fee of $50 each.

6. Free night awards apply to standard rooms only as defined by each participating property; contact the property before booking to check availability. To view the full terms and conditions, visit www.marriottbonvoy.com/terms.

7. Transfer ratios, minimum requirements and maximums, vary by airline. To view the full terms and conditions, visit www.marriottbonvoy.com/terms.

8. 5,000 bonus miles is awarded only when 60,000 points are transferred as part of the same transaction and is based on airlines with a 3 points to 1 mile conversion rate. Other terms and restrictions apply. To view the full terms and conditions, visit www.marriottbonvoy.com/terms.

9. Program Partners, prices and savings are subject to change without notice. Certain terms and restrictions apply. To receive savings with a partner, you must charge your eligible purchases to your Marriott Bonvoy Business American Express Card (in accordance with the terms and conditions applicable to that partner). Some Savings Program partners may require you to establish a customer account with them, in which they will record your Card information, in order to provide the discounts.

10. This product is administered by Belair Insurance Company Inc.

11. Purchase must be charged in full to an American Express Card. Subject to availability and to event and ticketing terms, restrictions, verification procedures and fees. Tickets and packages are not transferable and cannot be resold. No refunds and no exchanges subject to merchant's obligations under applicable law.

12. Underwritten by Belair Insurance Company Inc. You may contact the insurer at 1-833-964-2757 in Canada and the U.S. or visit https://info.client.insure.

13. Underwritten by Belair Insurance Company Inc. You may contact the insurer at 1-833-964-2757 in Canada and the U.S. or visit https://info.client.insure.

14. Underwritten by Belair Insurance Company Inc. You may contact the insurer at 1-833-964-2757 in Canada and the U.S. or visit https://info.client.insure.

15. Underwritten by Belair Insurance Company Inc. You may contact the insurer at 1-833-964-2757 in Canada and the U.S. or visit https://info.client.insure.

16. To be eligible to receive the 15 Elite Night Credits with this Card, you must be the Basic Cardmember, your Card Account must be in good standing at the time of the 15 Elite Night Credit deposit, and you must have an active Marriott Bonvoy program account. To receive the 15 Elite Night Credit deposit, your Card Account must be linked to a Marriott Bonvoy program account in your name. You will receive a maximum of 15 Elite Night Credits per calendar year even if you have more than one Marriott Bonvoy Consumer or Small Business credit card account or have more than one Marriott Bonvoy program account. American Express is not responsible for fulfillment of this benefit. It will take approximately 8 weeks from Card Account approval date for the credits to be applied to your loyalty account.

17. When you create an installment plan, you will be charged a monthly installment fee. The monthly installment fee percentage will be disclosed to you during plan creation. This is not a promotional or special rate offer. The fee charged is comparable to the interest you would have paid if you carried this balance on your account, without being in an installment plan. In order to create a new installment plan, your account must be in good standing and you must have a minimum $100 purchase or statement balance on your eligible card. Please see the Plan It (American Express Installment Program) section in your Cardmember Agreement or the Program Terms and Conditions for more details. Plan It is currently not available in Quebec, Nova Scotia, PEI or Nunavut.

18. When you apply for a Card through a third-party website, we may share your personal information, including card type, with that third party. The third party may use your personal and aggregated information for offer fulfilment and to improve the effectiveness of its advertising.

†: All insurance coverage is subject to the terms and conditions of the respective master policies. Certain limitations, exclusions and restrictions apply. Please read your Certificates of Insurance carefully.

®*: Used by Amex Bank of Canada under license from American Express.

®: 2025 Marriott International, Inc. All Rights Reserved. All names, marks and logos are the trademarks of Marriott International, Inc., or its affiliates, unless otherwise noted.

TM2025 Marriott International, Inc. All Rights Reserved. Sheraton, Westin, St. Regis, The Luxury Collection, W, Le Méridien, Design Hotels, Tribute Portfolio, Element, Aloft, Four Points and their respective logos are the trademarks of Marriott International, Inc., or its affiliates.